U.S. equity markets are widely recognized as the most efficient in the world, with deep pools of accessible liquidity, a well-established market data regime and a sound and predictable regulatory framework.

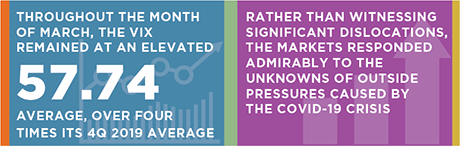

Throughout 2019, average daily volumes in the U.S. equities markets topped just over 7 billion shares per day. Meanwhile, during the fourth quarter, the VIX, an index of market-wide expectations of future volatility, had an average close below a fairly benign price of 14. The new year began closely in line with 2019, with volumes over 7.5 billion shares and the VIX hovering near 14. However, the onset of the COVID-19 pandemic, and the attendant significant uncertainty regarding the ultimate micro- and macroeconomic fallout, delivered a series of significant market shocks.

This paper is the first in a series of four examining U.S. capital markets at the onset of the COVID crisis. In order of publication, these reports will provide a detailed look into the performance of the equities (including options), fixed income (U.S. Treasuries and credit), global interest-rate derivatives, and foreign exchange markets during the crisis in the first half of 2020.

MethodologyThis Greenwich Associates research is primarily based on data from the first half of 2020 that was analyzed in July and August and conversations with liquidity providers, investors, regulators, exchanges and trading platform operators. The analysis also utilized numerous sources of both public and private data, including but not limited to FINRA, the Federal Reserve Bank of New York, OPRA, MarketAxess, Bloomberg, and BIS.