The pool of commissions earned by brokers on trades of U.S. equities within the Greenwich Associates universe contracted another 9% last year to an estimated $7.65 billion. That drop marked the fourth consecutive year of decline. The total commissions collected by brokers on trades of U.S. equities has dropped over one-third since 2011.

“Taking share is pivotal for brokers in the ‘zero-sum’ business of U.S. cash equities, as the continued passive investing, lower-cost electronic trading and modest volatility constrain volumes and commission generation,” says Greenwich Associates Managing Director Jay Bennett.

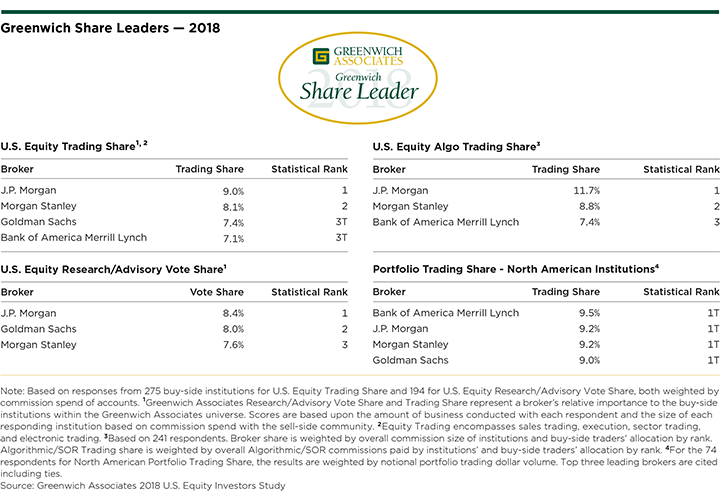

In this light, J.P. Morgan, Morgan Stanley, Goldman Sachs, and Bank of America Merrill Lynch rank as the 2018 Greenwich Share Leaders℠, besting all rivals across four U.S. equity categories.

The 2018 Greenwich Share Leaders in U.S. Equity Trading are J.P. Morgan in the top spot, followed by Morgan Stanley, and then Goldman Sachs and Bank of America Merrill Lynch, which are statistically tied for third place.

In the increasingly important category of U.S. Equity Algo Trading, J.P. Morgan tops the list by a wide margin over Morgan Stanley and Bank of America Merrill Lynch.

Looking at the Portfolio Trading Share with more dedicated investors, a group of four are statistically tied for first: Bank of America Merrill Lynch, J.P. Morgan, Morgan Stanley, and Goldman Sachs.

In the list of Greenwich Leaders in U.S. Equity Research/Advisory Vote Share, J.P. Morgan, Goldman Sachs and Morgan Stanley are tightly grouped, as each impacts the largest investors through a combination of strong corporate access and macro/industry research.

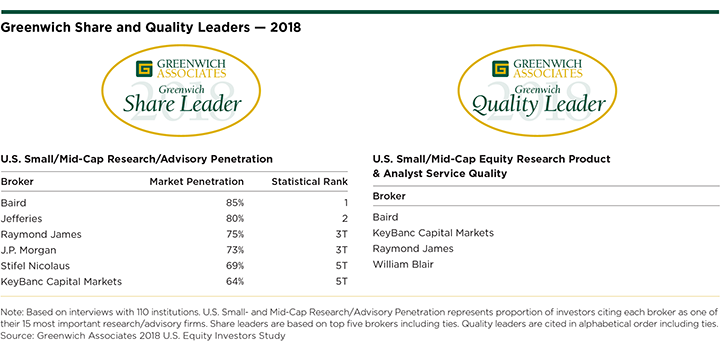

Baird maintains its position as the top broker used for U.S. Small/Mid-Cap Research/Advisory Penetration, closely followed by Jefferies. In a statistical tie for third place are Raymond James and J.P. Morgan, while Stifel Nicolaus and KeyBanc Capital Markets round out the top five.

Greenwich Quality Leaders

As part of its 2018 U.S. Equity Investors Study, Greenwich Associates interviewed 194 institutional portfolio managers and 275 institutional traders about the brokers they use for U.S. equities. Study participants were asked to name the brokers, estimate the amount of business done with each firm, and to rate the brokers in a series of product and service categories. Firms that received client ratings that top those of competitors by a statistically significant margin were named Greenwich Quality Leaders℠.

The 2018 Greenwich Quality Leaders in U.S. Equity Research Product & Analyst Service are J.P. Morgan and Sanford Bernstein. In U.S. Equity Sales Trading & Execution Service, Goldman Sachs, J.P. Morgan and Morgan Stanley rate as standouts. In U.S Equity Electronic Trading, the 2017 Greenwich Quality Leaders for the second year in a row are J.P. Morgan, Jefferies and Sanford Bernstein.

In a newer category, U.S. Equity Commission Management Service & Execution, ITG, Nomura/Instinet and Westminster Research are the 2018 Greenwich Quality Leaders. The 2018 Greenwich Quality Leaders in U.S. Small/Mid-Cap Research Product & Analyst Service are Baird, KeyBanc Capital Markets, Raymond James, and William Blair.

Consultants Jay Bennett, John Feng, Richard Johnson, and Lauren Anderson advise on institutional equity markets globally.

MethodologyBetween December 2017 and February 2018, Greenwich Associates interviewed 194 U.S. generalist equity portfolio managers, 110 small/mid-cap fund managers, 275 U.S. equity traders, and 74 portfolio traders at buy-side institutions. The study participants were asked to evaluate the sales, research and trading services they receive from their equity brokers and to report on important market practices and trends.