Market making in U.S. equity markets has changed significantly in the last two decades. The system, once ruled by large banks and brokers making markets on the NYSE floor or on Nasdaq’s electronic order book, is now dominated by smaller, less well-known electronic market makers—most established within the last 20 years.

Many market makers today got their start as the U.S. equity markets were changing, driven by competitive evolution and regulatory actions such as Reg NMS. At that time, any proprietary trading firm posting bids and offers on public exchanges could effectively become a market maker—without needing to register as such or committing to market-maker obligations. To the traditional institutional investing community, a new class of secretive, high-frequency trading companies appeared to be hijacking liquidity provision, leaving the buy side unsure and uncomfortable with the market as a whole.

Today, most market-making firms are registered as broker-dealers and as official market makers. While some have name recognition, most remain relatively unknown, with few market participants able to differentiate between bona fide market makers and high-frequency proprietary trading firms.

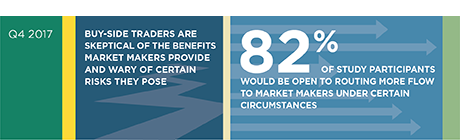

MethodologyFrom June through August 2017, Greenwich Associates interviewed 78 buy-side equity traders in the U.S. to learn more about order-routing preferences, trading-desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.