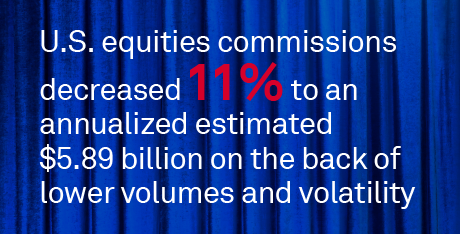

The U.S. equity trading landscape is a theater of evolution. Strategies, preferences and technology adoption among asset managers are transforming, shaping the way both the buy and sell side must navigate this complex ecosystem. This research report serves as an insider’s view—a backstage pass offering quantifiable insights gleaned directly from asset managers at stage level. Through comprehensive analysis, it provides an examination of pivotal trends among trading channels, commission allocation, broker concentration, electronic broker selection, and commission management programs. For example, while electronic trading continues to gain traction, it still plays second fiddle to high-touch sales trading. Sourcing natural liquidity remains the buy side’s primary determinant in allocating a diminishing commission wallet, and desks are reducing their broker lists while concentrating flow to their top providers.

MethodologyFrom January through June 2023, Coalition Greenwich interviewed 235 buy-side equity traders in North America. The study was conducted over the phone, online and in-person. Respondents answered a series of qualitative and quantitative questions about the brokers they use and their business practices in the U.S. cash equity space.