While total notional volumes in U.S. retail structured products remained relatively flat, only declining about 3% from 2013 to 2014, volumes among third-party distributors jumped over 50%. Retail remains by far the largest channel for retail structured product distribution, accounting for over half of reported volumes.

As the financial crises fades from memory, creditworthiness continues to recede as a concern for clients. “We are now seeing product manufacturers differentiating more based on understanding clients’ needs, having innovative products and providing marketing support to their clients,” says Greenwich Associates consultant David Stryker. Nevertheless, competitiveness of pricing remains the most important key selection factor, cited by 76% of third-party distributors and 60% of affiliated distributors.

The U.S. retail structured product market is again dominated by HSBC, J.P. Morgan and Barclays. However, investors’ ebbing concern with credit risk, coupled with a number of banks stepping back from the market, has allowed banks outside the Top 3 to make meaningful progress in their footprint over the past year. BNP Paribas has grown its footprint in U.S. retail structured products more than any other bank and is starting to close the gap on the market leaders.

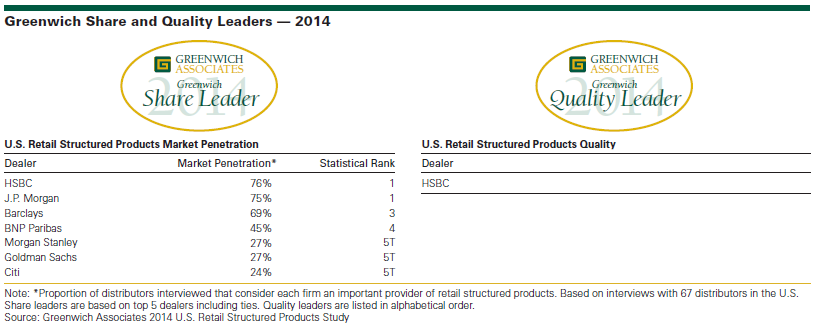

HSBC and J.P. Morgan are the clear leaders with market penetration scores of 76% and 75%, respectively, followed closely by Barclays with 69%. BNP Paribas has leapfrogged into the #4 spot with a score of 45%. Rounding out the 2014 Greenwich Share Leaders with a three-way tie in U.S. Retail Structured Products are Morgan Stanley and Goldman Sachs, at 27%, and Citi at 24%. The 2014 Greenwich Quality Leader in U.S. Retail Structured Products is HSBC.

Consultants Andrew Awad and David Stryker advise on the retail structured products and fixed-income markets.

MethodologyBetween April and June 2014, Greenwich Associates conducted telephone interviews with 67 distributors of retail structured products in the United States to better understand product demand, distributor preferences and the competitive landscape. Respondents were asked to name the firms they used for retail structured products and to rate those providers in a series of product and service quality categories. Quality Leaders have distinguished themselves from their competitors by receiving service quality ratings that exceed those of competitors by a statistically significant margin.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants.

They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. All rights reserved. Javelin Strategy & Research is a subsidiary of Greenwich Associates. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.