The U.S. stock market has grown vastly more complex over the past two decades. Where over three-quarters of all trading volume was once handled by just two exchanges, today liquidity is spread out across over a dozen stock exchanges and over an array of both registered alternatives trading systems and non-ATS venues. In addition, decimalization, high-speed trading and complex order types further complicate U.S. equity trading. To determine the best way to navigate today’s market structure, traders need better tools to provide insights into the performance of each venue and the impact of routing behavior.

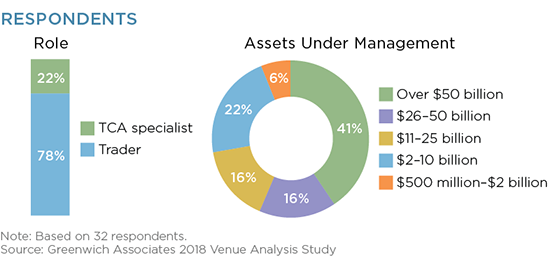

MethodologyBetween April and May 2018, Greenwich Associates interviewed 32 buy-side trading professionals in the U.S., comprised of traders and TCA specialists. Respondents were asked a number of quantitative and qualitative questions about the buy side’s usage of venue and routing analysis as part of their trade optimization and best execution process.