One-on-one conversation has and will always be at the center of the financial markets. From its origins at the foot of the buttonwood tree in New York and in Jonathan’s Coffee House in London, buyers and sellers would meet and verbally communicate their interest to buy and sell and negotiate on price and quantity. Of course, trading has evolved significantly since those early days—to exchange floors and, in the past two decades, to trading desks all over the world.

Even as trading has become more electronic and geographically diverse, the role of voice communication remains as important a part of the trading process today as it was all those centuries ago. While the transmission of order details such as symbol, side, quantity, and price are communicated electronically, additional instructions, market color and unique insights on current market conditions are often best delivered via a phone call.

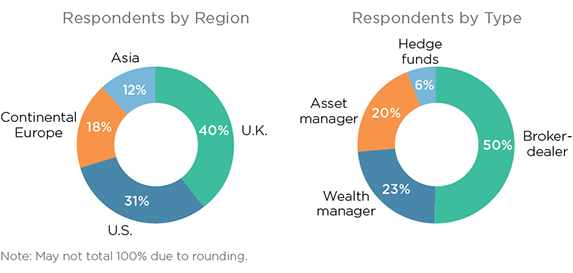

MethodologyIn the summer of 2016, Greenwich Associates interviewed 108 trading professionals to learn about their use of voice communication tools.

Interviews were conducted electronically with respondents in Asia, Continental Europe, the United Kingdom, and the United States. Respondents were asked a series of qualitative and quantitative questions about the use of voice in the trading process, how trading turrets are used and their expectations for the future.