While the popular perception is that mid-size banks may have limited direct exposure to industries facing transition risk, it is important to acknowledge that neither are they immune to reputational risks nor to the potential second-order effects that accrue from concentration to regional market economies, both on the retail and the business loan books.

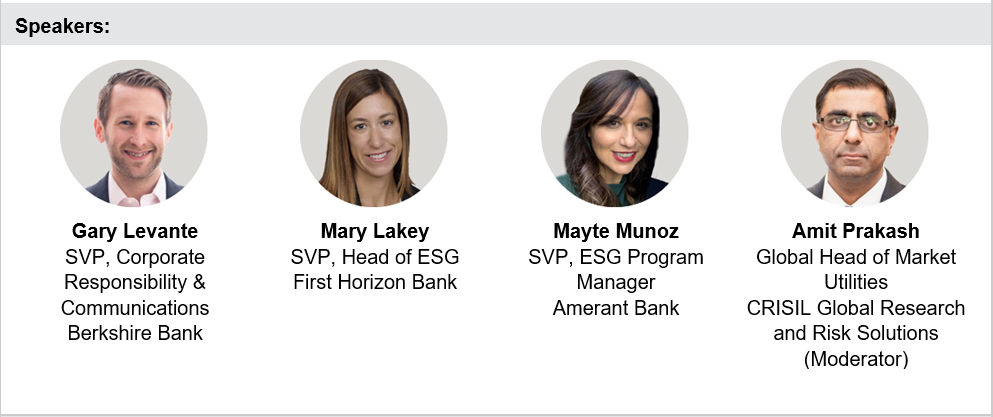

Apart from risks that need to be managed, banks also have the opportunity to benefit from the rapidly expanding sustainable financing market. Our recent survey of mid-size U.S. banks reveals the segment is poised to see plenty of action on the integration of sustainability in 2022 - 2023. Banks in the early stages of their sustainability journey have the advantage of being able to learn from the experience of their relatively more advanced peers. Join us for a practical conversation with ESG heads at banks that have made significant progress in their sustainability adoption journey.

The panelists on the webinar will share their insights on:

- Establishing the building blocks which include an execution task force, oversight framework, formulation of the sustainability strategy and drawing up roadmaps

- Execution of the strategy through integration across business functions and various risk stripes

- Key considerations for planning and execution of the external disclosure process

- Implications of the SEC’s recent climate risk disclosure proposals on mid-size bank