Table of Contents

A partial retreat in Asia by several global fixed-income dealers, including some with historically prominent Asian franchises, does not reflect any diminished growth opportunities in the region—rather the results of hard decisions banks have been forced to make about how and where to allocate capital. In fact, even as certain banks from Europe, the United States and Australia retrench in Asia, others are stepping in to fill the void.

In the short term, the primary result of these strategic shifts has been that the market’s strongest dealers have gotten stronger. Over the past 12 months, growing trading volume has been concentrated in the hands of the market’s four leading dealers. At the very top of the market, Citi has continued to win market share and now stands tied with HSBC.

“Citi has been a powerhouse across products over the last year, and HSBC, which remains dominant in domestic currency Asian bonds and extremely strong in G3 Asian bonds, has also made considerable progress in developed-market rates products,” says Greenwich Associates Managing Director James Borger.

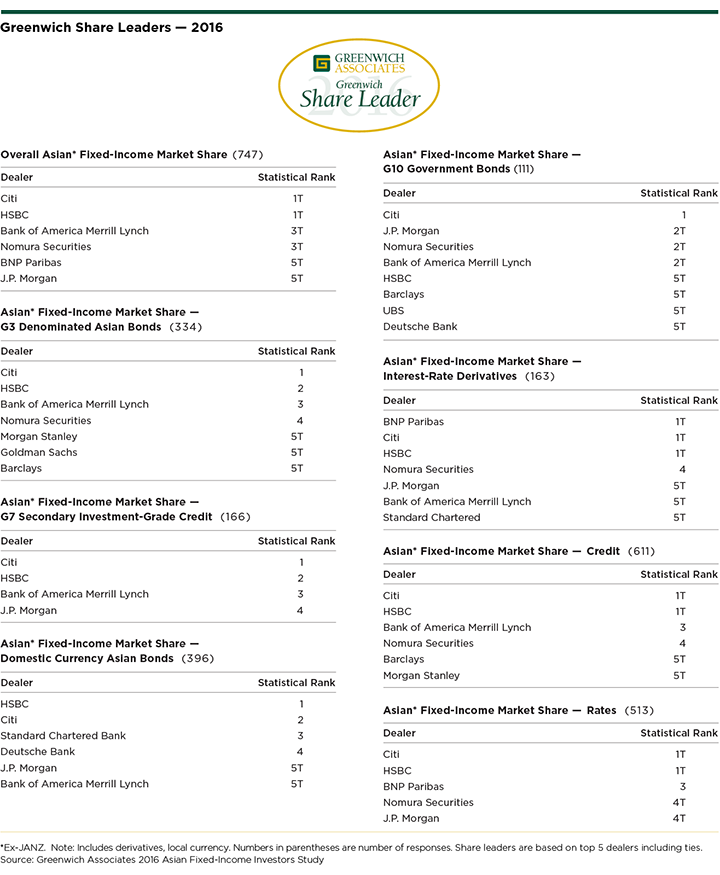

Bank of America Merrill Lynch and Nomura Securities statistically tie for third in share. These top four are joined by fifth place finishers BNP Paribas and J.P. Morgan as the 2016 Greenwich Share Leaders℠ in Overall Asian Fixed Income (excluding Japan and Australia/New Zealand).

Behind the top market leaders, several dealers from Europe and the U.S. are expanding their footprints in Asia. J.P. Morgan has always been effective at exporting Asian debt to U.S.- and Europe-based investors but has recently made significant gains among Asia-domiciled clients. Goldman Sachs is winning relationships and market share in G3 bonds, U.S. investment-grade bonds and developed-market rates products. BNP Paribas has asserted itself in swaps trading. Wells Fargo has established a growing presence selling U.S. Treasury bonds and investment-grade credit products to Asian investors.

“The strategies of these dealers show they still see Asian fixed income as having potential,” says Greenwich Associates Vice President Parijat Banerjee. “These are smart banks that don’t follow the herd, and they are committing new resources into an Asian market that they still see as a driver of future growth and an important piece to being a global franchise.”

Greenwich Share and Quality Leaders

A look at the complete list of Greenwich Share Leaders shows the strength of Citi and HSBC across the full spectrum of Asian fixed-income products. The two firms tie for first place in Rates Products while Citi holds the top spot in G3-Denominated Asian Bonds in terms of market share, followed by HSBC in second place. That same result appears in Asian Credit Products, G7 Secondary Investment-Grade Credit Products. In G10 Government Bonds, Citi ranks first, followed by a three-way tie among J.P. Morgan, Nomura Securities and Bank of America Merrill Lynch. HSBC holds a commanding lead in Domestic Currency Asian Bonds, with Citi in the No. 2 spot. In Interest-Rate Derivatives, BNP Paribas, Citi and HSBC are deadlocked atop the market.

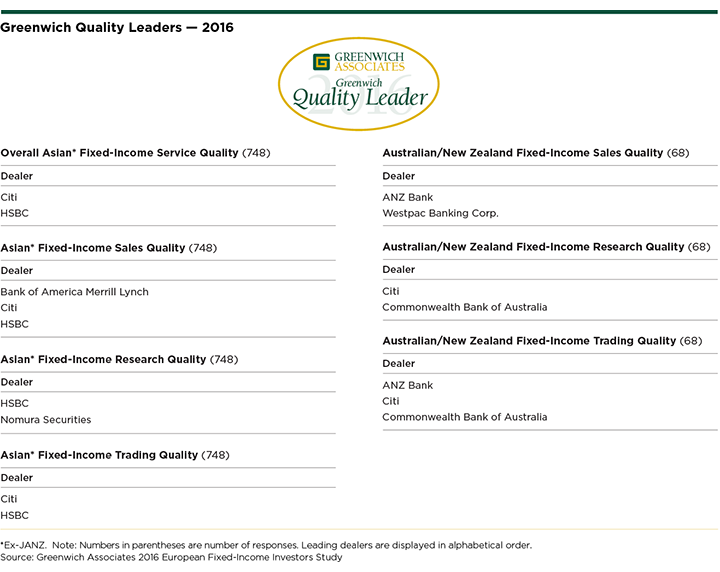

Greenwich Associates asked the 815 Asian investors interviewed for its 2016 Asian Fixed-Income Investors Study to name the dealers they use in a variety of products and to rate the quality delivered by these banks. Dealers receiving quality ratings topping those of competitors by a statistically significant margin were named Greenwich Quality Leaders℠. Taking into account dealers’ overall Asian fixed-income franchises, the 2016 Greenwich Quality Leaders are Citi and HSBC. Reflecting their leading market shares in the trading of most Asian fixed-income products, Citi and HSBC also claim the title of Quality Leaders in Asian Fixed-Income Trading and share the title with Bank of America Merrill Lynch in

Sales. Nomura Securities and HSBC are the 2016 Quality Leaders in Research.

Australia and New Zealand

NZ Bank and Westpac Banking Corp. are the 2016 Greenwich Quality Leaders in Fixed-Income Sales, and Citi and Commonwealth Bank of Australia claim the title in Fixed-Income Research. In Fixed-Income Trading the 2016 Greenwich Quality Leaders are ANZ, Citi and Commonwealth Bank of Australia.

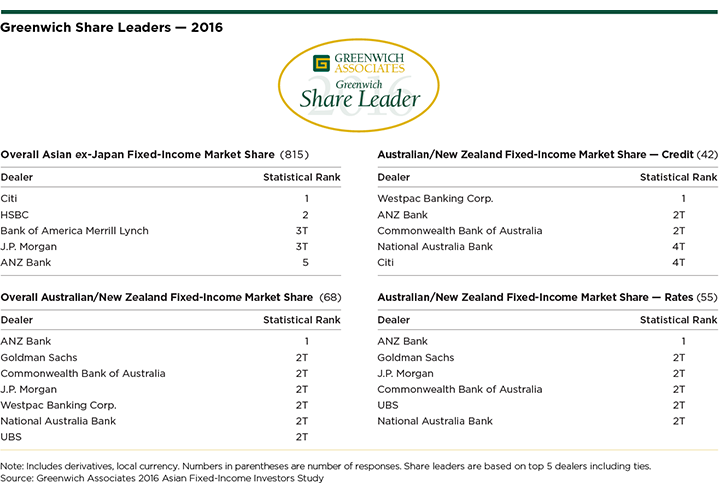

Although ANZ Bank has scaled back its pan-Asian ambitions for now, the bank remains dominant in its home market of Australia/New Zealand. ANZ has built a commanding lead over the competition in terms of market share in Fixed-Income Trading. Behind ANZ is a tightly bunched group of domestic and foreign dealers with market shares separated by less than 100 basis points. ANZ leads the market in Rates Products trading, with a market share a full four percentage points higher than the group of five dealers tied for second place. In Credit Products, Westpac tops ANZ, which is tied for second place with Commonwealth Bank of Australia, followed by National Australia Bank and Citi tied for fourth. These banks are the 2016 Greenwich Share Leaders in Overall Australian/New Zealand Fixed Income.

Asia including Australia / New Zealand

To better reflect the way certain global firms structure their Asian businesses, we feature for the second year a regional cut that includes Australia and New Zealand with the rest of Asia, excluding Japan. Citi leads in Overall Asian ex-Japan Fixed-Income Market Share, followed by HSBC in second, Bank of America Merrill Lynch and J. P. Morgan tied for third, and ANZ Bank completing the top five.

Managing Director James Borger and Vice President Parijat Banerjee advise on the institutional fixed-income markets in Asia.

MethodologyBetween May and July 2016, Greenwich Associates conducted 815 interviews with fixed-income investment professionals at domestic and foreign banks, private banks, investment managers, insurance companies, hedge funds, corporations, central banks, and other institutions throughout Asia (ex-Japan). Countries and regions where interviews were conducted include Australia/New Zealand, China/Hong Kong/Macau, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Sri Lanka, Taiwan, and Thailand. Interview topics included service provider assessments, trading practices, market trend analysis, and investor compensation.