While fixed-income dealers are finally coming out from underneath the crush of the financial crisis, budget cuts and regulatory burdens continue to impact their ability to effectively service clients. Interactions with compliance are increasingly keeping trading desk heads away from clients, which both hurts the profitability of the desk and the level of service clients receive.

Nothing can truly replace personal relationships, but technology on the trading desk can certainly help augment them. MiFID II is proving to be a catalyst for technology upgrades on the desk—some out of necessity, some out of a desire to grow. These will help banks struggling to prepare for the directives quickly approaching implementation.

Just as major regulatory overhauls have in the past, MiFID II will gradually become business as usual. But applying technology to the challenge at hand is the best way to ensure that compliance requirements are met and that client service levels continue to improve year after year.

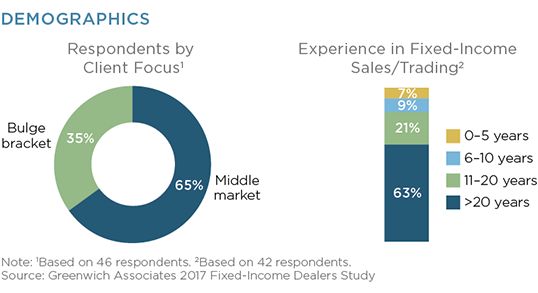

MethodologyIn the second quarter of 2017, Greenwich Associates interviewed 46 fixed-income traders and sales professionals at sellside organizations in the U.S. and Europe in an effort to understand the changes facing their business models and careers. Participants included both global and regionally focused banks, with individuals comprising a mix of traditional voice sales and those focused on e-commerce initiatives.