Institutional investors trading FX, while closely monitoring market structure changes, have seen their trading operations reach somewhat of an equilibrium.

Although market volatility at the hands of Brexit and President Trump have increased market risk, regulatory uncertainty has remained relatively low, with FX spot markets left fairly untouched.

Increasing efficiency on the desk is currently the biggest focus for head traders. With budgets and headcount roughly flat, improved performance will come from better execution strategies and the technology needed to implement new approaches.

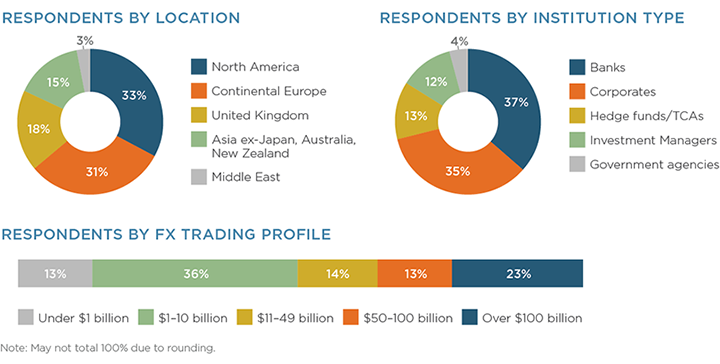

MethodologyFrom June through August 2016, Greenwich Associates interviewed 78 buy-side traders across the globe trading foreign exchange to learn more about trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.