The electronic trading revolution hit the foreign-exchange market years ago, but the macroeconomic and regulatory-driven events of the past few years are spurring a new wave of change.

Investors are increasingly focused on best execution, utilizing sophisticated analytics to direct counterparty selection and to ensure their clients are trading as efficiently as possible.

At the same time, the dealers are adapting to the impact of new rules that change the economics of FX liquidity provision and finding themselves increasingly competing for flow with non-bank, high-tech liquidity providers.

While the result is a more complex market in the short term, the long-term result is a more liquid, transparent and efficient market for all.

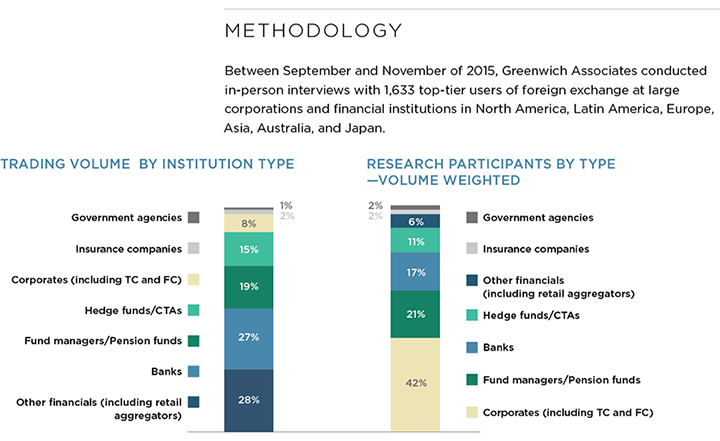

MethodologyBetween September and November of 2015, Greenwich Associates conducted in-person interviews with 1,633 top-tier users of foreign exchange at large corporations and financial institutions in North America, Latin America, Europe, Asia, Australia, and Japan.