A decade on from the financial crisis, which triggered the bond-dealer balance sheet reduction, institutional corporate bond investors are finally feeling some liquidity relief.

Electronic trading over the past few years has eased the buy side’s ability to execute odd-lot orders.

Many of those same tools have now found their way into the block-trade ecosystem, with over three-quarters of corporate bond investors feeling it is easy or extremely easy to execute orders up to $5 million in size. This is a stark contrast to the sentiment only a year ago.

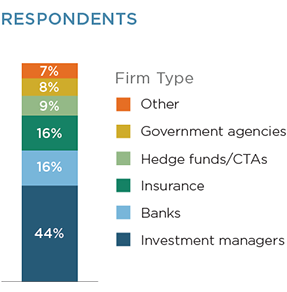

MethodologyFrom June through November 2017, Greenwich Associates interviewed 100 buy-side traders across the globe working on fixed-income trading desks to learn more about trading desk budget allocations, trader staffing levels, OMS/EMS, TCA platform usage, and the impact of market structure changes on the fixed-income sector.