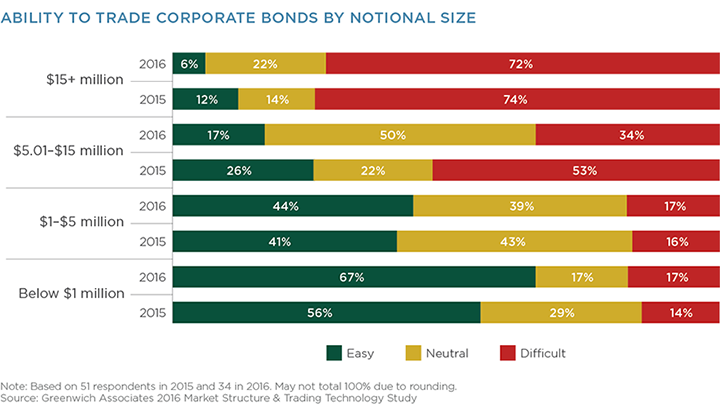

Trading corporate bonds is finally getting a little easier. No, we are not going back to the good old days, nor are the Trump administration’s promises to scale back financial regulations—and the Volcker Rule in particular—driving banks to take on large bond positions again. What we are seeing, however, is an adaptation to the current market structure and with that, a smaller but much more efficient buy-side trading desk.

Two-thirds of the investors we spoke with believe that executing corporate bond orders of $1 million in notional size or less is now easy, up from 56% the year before. Corporate bond execution venues and offerings that were a mere idea a few years ago are finally consolidating and starting to bear fruit. Meanwhile, the quantity of data available has grown, along with the number and quality of tools to analyze and action the data.

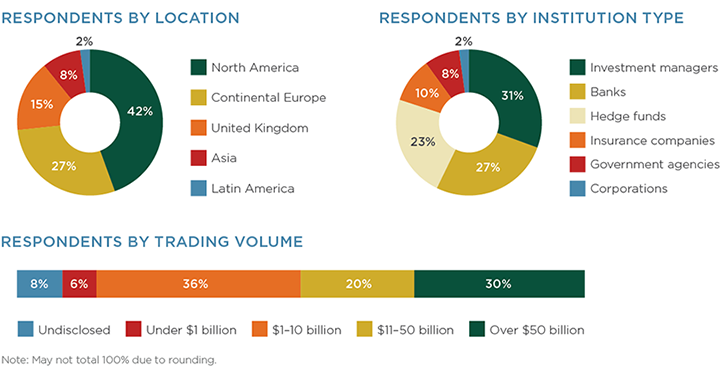

From June through August 2016, Greenwich Associates interviewed 52 buy-side traders across the globe trading fixed-income products to learn more about trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.