The top five dealers in U.S. Treasuries handled 58% of client trading volume in 2016, and the top 10 a collective 85%.

In 2009, just following the credit crisis, these numbers looked remarkably similar. This is surprising, given how much has changed in the global markets in the in the past seven years. Even the names of the top banks have remained the same for the most part, save some notable changes such as the merger of Bank of America and Merrill Lynch.

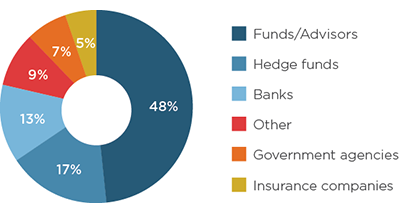

MethodologyBetween February and April 2016, Greenwich Associates interviewed 998 U.S. institutional investors active in fixed income, including 95 active in U.S. Treasuries. Interview topics included trading and research activities and preferences, product and dealer use, service provider evaluations, market trend analysis, and investor compensation.