The performance of 95% of institutionally managed credit funds and 97% of interest-rate-focused funds are benchmarked against an index. While absolute investment performance is important, institutional investors are judged and compensated more commonly on their relative performance. Think of it as grading on a curve—a C+ on a math test is bad if everyone else got an A, but it should be rewarded if everyone else failed.

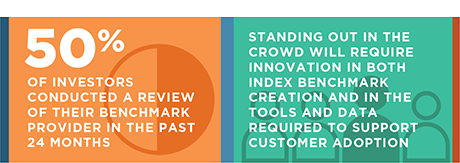

For fund managers, choosing the right benchmark is clearly of critical importance. Not all benchmarks and, perhaps more importantly, not all benchmark calculations are alike. Pensions, endowments and other asset owners must therefore ensure they are thoroughly educated about all aspects of the indices to which the performance of their assets (and the corresponding fees they pay to their fund managers) are tied.

While always important, several macro factors have added additional complexity to the task of benchmark selection. For instance, low interest rates and low credit spreads over U.S. Treasuries have left investors struggling to find new ways to generate returns. This has led to a variety of investing strategies which utilize new combinations of fixed-income instruments, all needing appropriate benchmarks against which to measure relative performance.

The passive investment boom in general, and the growth in fixed-income ETF assets under management more specifically, have also driven demand for new and more specialized indices. Greenwich Associates interviews with over 1,000 U.S. institutional investors found that 25% now utilize passive fixed-income investment strategies. In an effort to capture these assets, ETF providers are developing ever more creative funds that look at narrow slices of the fixed-income market. Each of these need a custom benchmark to gauge performance—a trend with no sign of abating.

And while technology advancements and increased data quality have made it easier to calculate, trade with and trade alongside an index, it has also driven a boom in custom indices that offer the industry highly relevant options. But this optionality has also created a more difficult selection process.

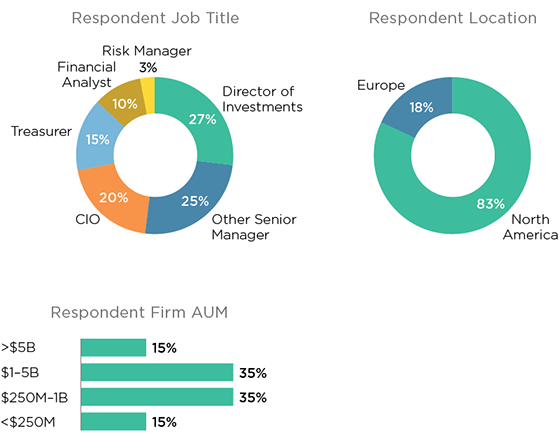

MethodologyGreenwich Associates interviewed 40 directors of investment at public and private pensions, foundations and endowments in the United States and Europe, with a goal of better understanding their current benchmark selection process, how it has changed over time and how they expect it to change going forward. The study focused on the fixed-income market, where market structure changes have driven a greater need for new and custom benchmarks.