With much of the SEF mandate shock behind us and true execution data more readily available than ever before, examining the order book’s potential beyond its current usage is prudent. For the dealer community, it seems likely that more and more vanilla trades will find their way to the screen as the need to cut costs makes phone-based brokerage fees harder to justify. For clients, most of whom feel they’re getting best execution via name-disclosed RFQ, drivers for change are, on the surface, still relatively limited.

However, examining liquidity available in other market centers—in this case those with order books—at the time of the actual execution can provide insight into how investors can achieve improved results in the future.

Methodology

Greenwich Associates examined trading data for nearly 100 interest-rate swaps executed in July and August of 2015. The analysis focused on benchmark USD interest-rate swaps, examining a nearly even mix of outrights (10 year), butterfly (2/5/10) and curve (10/30) trades. Historical trade data was obtained from the DTCC swap data repository, and tick-level order book data was obtained from both ICAP and Tradition. Data Scientist Orlando Joe Almodovar aided in the quantitative portion of this study.

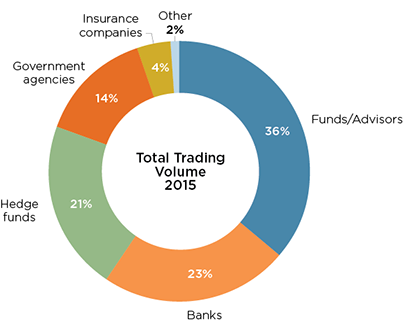

Greenwich Associates also interviewed 111 interest-rates derivatives institutional investors in the U.S. between February and April 2015 about their trading activities and preferences, product and dealer use, service provider evaluations, market trend analysis and compensation.