Each year experts from Greenwich Asscoiates evaluate bank digital platforms extensively and ask management detailed questions about their systems. Bank participants in the program are able to anonymously and objectively rate the specific features and functions that are currently available to corporate/commercial banking clients through Internet-based, mobile and other electronic channels, such as SWIFT and host-to-host connectivity, relative to other leading banks and non-bank providers.

While the rule changes have yet to be proposed formally, the Chairman and Chief Economist at the CFTC recently released a white paper outlining their thoughts about and plans for the swaps market going forward. All the major elements of the post-credit-crisis swaps market are examined—trading, clearing, reporting, and participant registration. But the proposed SEF changes are likely to be particularly impactful, especially given the major innovations in electronic trading since the rules were written back in 2011. SEFs are set to both gain some flexibility and lose some control.

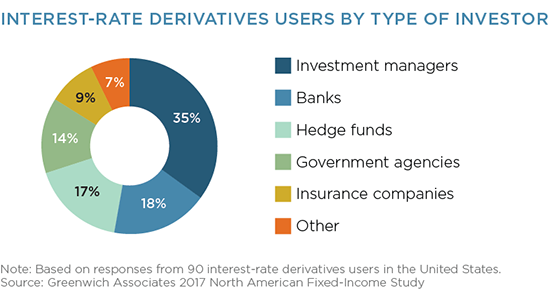

MethodologyBased on conversations with regulators and market participants in the second quarter of 2018 and interviews with 90 interest-rate derivatives investors in the United States in 2017.