Just as the U.S. swaps market was starting to feel some market structure certainty, the political situation in Washington was upended, bringing uncertainty back.

The Republican president and Congress are talking a big game about scaling back Dodd-Frank, which will inevitably impact swaps market participants in a variety of ways. While we are confident that the core tenets of Title VII will remain intact—SEF trading, central clearing and trade reporting—we expect regulators to take a hard look at the rules written over the past five years and adopt a less prescriptive, more principles-based approach.

Even so, this change will take time, with much of it providing a positive boost to the swaps market. The market’s current equilibrium coupled with these positive sentiments suggest a compelling story in the months to come.

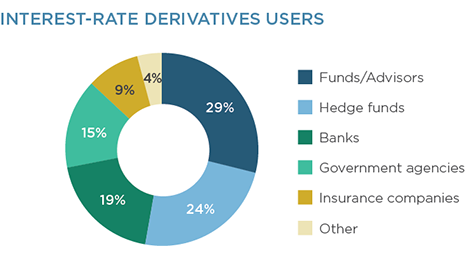

MethodologyBetween February and April 2016, Greenwich Associates interviewed 998 U.S. institutional investors active in fixed income, including 97 interest-rate derivatives users. Interview topics included trading and research activities and preferences, product and and dealer use, service provider evaluations, market trend analysis, and investor compensation.