Evolution in the U.S. corporate bond market accelerated in 2019. In fact, the slow and steady change that has occurred over the past decade will ultimately be seen for the revolution that it brought about.

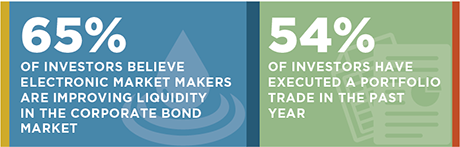

In 2019 alone, we saw overall electronic trading grow, auto-execution become common, portfolio trading hit the mainstream, and electronic market makers stake their claim, with investors by-and-large embracing the change. Equity investor views of those in fixed-income electronic trading can't be ignored either. Tradeweb's successful IPO created a renewed focus on everyone in the sector. Tradeweb has a market capitalization of $10 billion and Market Axess $14.4 billion as of early December 2019. This puts them in the same category as long-established exchanges like CBOE, LSE and Nasdaq, reminding us that these and other corporate bond trading platforms are no longer "ECNs" but instead major market centers.

Market uncertainty in 2020 should only help this train accelerate. While volatility and volume came in and out through 2019, the U.S. presidential election, coupled with a seemingly unstoppable bull market that many expect to end, will only generate more activity for U.S. corporate bonds. For the last several years, we wondered if the new market structure for trading corporate bonds—one where the role of dealer capital was lessened and technology involvement increased—was sufficiently robust to carry on for the long term. We're not wondering anymore.

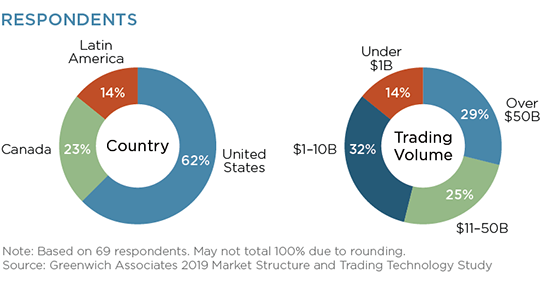

MethodologyThroughout September and October of 2019, Greenwich Associates interviewed 69 corporate bond investors in the Americas as a part of our annual Market Structure and Trading Technology Study. Respondents were asked about their trading habits, electronic trading adoption, platform usage, and views on market structure issues.