The first half of 2020 proved to be the biggest test to date for the newly electronic fixed-income market structure. While official sector intervention was clearly needed to stabilize markets in March 2020, the infrastructure for trading corporate and municipal bonds proved impressively robust. Clients were reminded how important their dealer relationships were, while at the same time electronic trading platforms showed they could handle what turned out to be historic trading and data volumes.

Nevertheless, the market shock forced all market participants to rethink various aspects of their business and operating models. The widely held belief that traders could never work from home has clearly been debunked. Perceived volume limits for fixed-income electronic trading were all broken. The toolkit of the Federal Reserve proved to be considerably bigger and more diverse than the market ever imagined.

Also, it’s been made clear that relationships really matter—not just for access to new issues or balance sheet, but for help in understanding what in the world is going on. The bond market has absolutely been transformed by technology over the past decade—that is undeniable. But trading bonds is still very much a people business, where understanding your customer matters, even if technology and data help with that understanding.

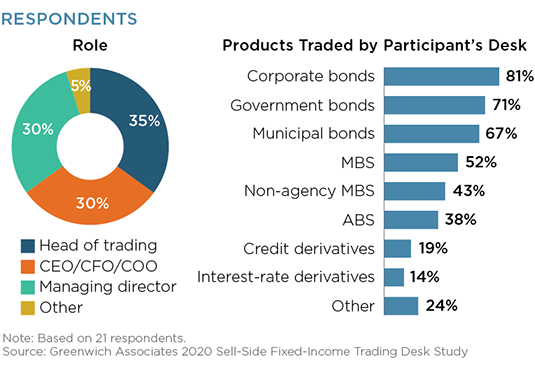

This study, conducted in the summer of 2020, examines the growth priorities, technology spending and market structure views of regional and middle market corporate bond and municipal bond dealers in the United States. While this group is diverse by definition, including some banks that are truly global and others that are particularly focused on a single region of the U.S., their participation in the bond market is critical and continues to evolve along with the overall market.

MethodologyGreenwich Associates, in partnership with BDA, sought responses from key corporate bond and municipal bond dealers in the United States (including BDA member firms). Interviews were collected from 21 firms during July and August 2020 via an electronic survey. This research examines the impact of the COVID-19 crisis on fixed-income trading desks, corporate bond and municipal bond market structure, the use of technology, the evolving skillset of sales and trading professionals, and the evolution of operating a sell-side trading desk.