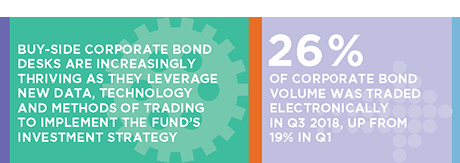

The boom in new corporate bond trading platforms is over. Institutional corporate bond investors have voted with their feet, utilizing those tools that work best within the current market structure. We are now in a phase of refinement, where the shock of big change is behind us and time can be spent ensuring new processes move toward business as usual.

However, this market structure equilibrium has come at a time when change in the macro environment is beginning to accelerate. Interest rates, volumes and volatility are steadily increasing and, thereby, testing the corporate bond market’s infrastructure, which now has less dealer balance sheet and more virtual balance sheet.

History tells us that as markets speed up, the leveraging of technology will accelerate in lock step. While human intuition and relationships still hold considerable weight, no one is successful in the market today without technology augmentation. Resorting back to the “old way” is simply not feasible.

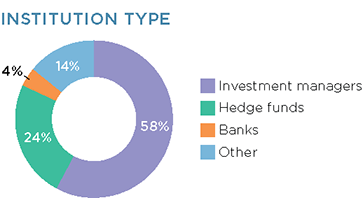

MethodologyDuring Q2 and Q3 2018, Greenwich Associates interviewed 269 corporate bond traders as a part of its 2018 Market Structure and Trading Technology and 2018 U.S. Fixed-Income Investors Studies. Respondents were asked a series of quantitative and qualitative questions about their execution tendencies, electronic trading usage and expectations for the near future.