The global derivatives market has undergone tremendous change over the past decade and, by most measures, has come out more robust and efficient than ever. Increased transparency, more central clearing and vastly improved technology for trading, clearing and riskmanaging everything from futures to swaps to options has created an environment in which nearly 80% of the market participants in this study believe liquidity in 2020 will only continue to improve.

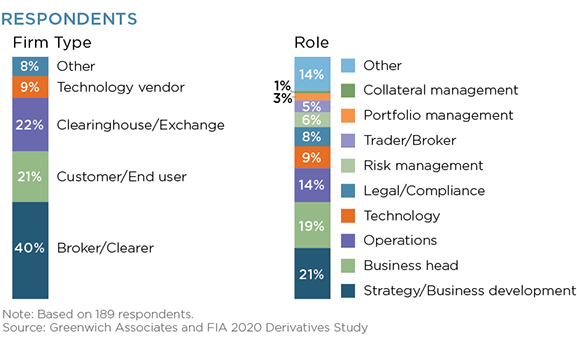

To understand more deeply where we’ve been and where the derivatives market is headed, Greenwich Associates conducted a study in partnership with FIA, an association that represents banks, brokers, exchanges, and other firms in the global derivatives markets. The study gathered insights from nearly 200 derivatives market participants—traders, brokers, investors, clearing firms, exchanges, and clearinghouses—examining derivatives product usage, how they manage their counterparty relationships, their expectations for regulatory change, and more.

The results painted a picture of an industry with the appetite and opportunity for growth, but also one with challenges many are eager to see overcome. The approaching Libor transition, continued rollout of uncleared margin rules, ongoing concern about capital requirements, and a renewed focus on clearinghouse “skin in the game” are on the minds of most derivatives market participants. Each of these issues contain as many opportunities for the market as complexities and, ultimately, will help the market safely grow as derivatives maintain their critical place in global finance.

The results also provided important insights into the dynamics of derivatives clearing as a business. Clearing firm respondents said they are investing in growth by extending their services into new geographies and expanding the scope of the products they clear. But they are setting a higher priority on making improvements to their internal workflows and client service. That reflects one of the key findings from customers: 64% cited “quality of operational processes” as an important measure for their clearing firm relationships.

MethodologyThis research is based on data collected from 189 derivatives market participants between November 2019 and January 2020. Respondents include asset managers, hedge funds, broker-dealers, clearing firms, proprietary trading firms, exchanges, clearinghouses, and other industry participants. Questions asked were about their habits, opinions and expectations for the global derivatives markets in the next 3–5 years. Greenwich Associates collaborated with FIA to both develop the questionnaire and to gather responses from key industry participants.