Portfolio managers aren’t the only ones generating alpha. While trading was once only a necessary cost for implementing an investment strategy, trading desks today—with the right market access, platform technology and data—routinely act as alpha contributors, as they strive to beat execution expectations.

While this is true in many markets around the world, the gap between reality and opportunity is noticeably wider in Asian bond markets. Although electronic trading adoption and market transparency have increased in the last decade, market norms grounded in local culture and traditional relationships, and diverse, varied regulatory regimes continue to leave global bond investors yearning for the more structured, electronic markets of Europe and the United States.

Progress in electronification is apparent, but the roadblocks to significant change cannot be underestimated. Changing cultural norms is often harder than changing the technology itself. Relationships are still critical when trading bonds, and so fears that e-trading will disrupt those long-held partnerships leave many in Asia nervous. And on both buy and sell side, many are as yet unconvinced by the cost-benefit analysis of e-trading—even while execution cost-savings in the U.S. and most of Europe continue to rise as data and technology improve.

For Asian bond markets to truly realize their potential on the global stage, these roadblocks must be overcome. Increasing the adoption of e-trading is not just about easing the burden on traders or helping investment funds generate more alpha. E-trading almost always brings with it greater price transparency, which then results in improved liquidity—and improved liquidity can lead to greater demand for those bonds. Greater demand for bonds means lower borrowing costs for the companies and countries borrowing to drive the entire economy forward.

We are not suggesting e-trading is a main driver of broad economic growth, of course, but evidence suggests that e-trading helps create more efficient capital markets that ultimately allow the world to grow and improve.

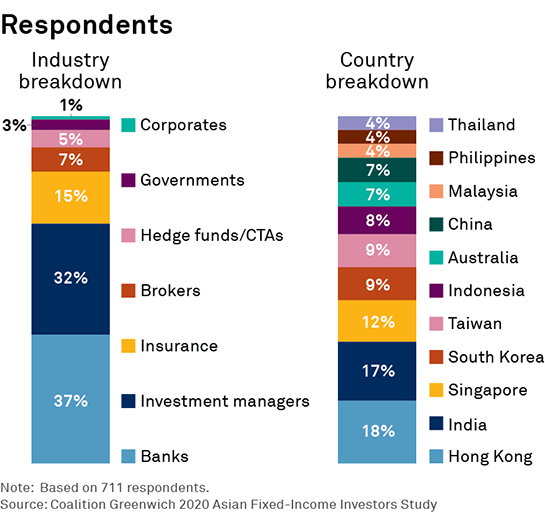

This research, based on interviews with 700 Asian bond investors trading over $2 trillion of domestic- and hardcurrency bonds in 2020, examines the current state of fixed-income e-trading in Asia, roadblocks to progress and areas for growth in the coming years.

MethodologyThis research is based on interviews with 700 Asia-based fixed-income investors in late 2020, and conversations with Asia-based dealers and platform providers in 2Q 2021. Topics included dealer relationships, trading volumes, electronic trading adoption, and market structure changes.