Trading desks run by asset managers and hedge funds have long been supported by a combination of portfolio management systems (PMS), order management systems (OMS) and execution management systems (EMS). These systems were each built with a very specific job function in mind—and often a single asset class—and then tied together with a combination of FIX messages, proprietary APIs and spreadsheet uploads. This trading workflow emerged in the 1990s, as technology and the internet pervaded capital markets. Since then, the markets have changed significantly, particularly those over-the-counter markets in which electronic trading is a new phenomenon. It is time for the trading workflow to follow suit.

Portfolio managers, traders, operations, and compliance staff all continue to perform separate functions and, as such, need screens that reflect those job responsibilities. But more than three decades of workflow improvements and technology innovation still require that individuals not interfere or diminish the needs of others—whether in the user interface or the system’s ability to process data.

Thinking about the progression of trading technology as simply combining the OMS and EMS into the long sought-after OEMS is misguided. Smartphones aren’t a combination of a corded landline and an under-the-desk PC tower, for instance, they are something completely new. The same should be true here. While the pace of electronification is unclear, particularly in the most bespoke and illiquid corners of the market, technology can still inject much-needed efficiency today.

Institutional investors looking for new or improved trading desk technology should search for an enterprise trading platform and not necessarily what was historically viewed as an EMS or OMS. It would, of course, be naive to think that everyone can and will now buy a single solution from a single provider. The world is more complex than that, and good technology is available from many different sources. Nevertheless, the time has come to throw out long-held notions of what trading technology can do and how it has been packaged. Instead, consider what it should do and what you really need.

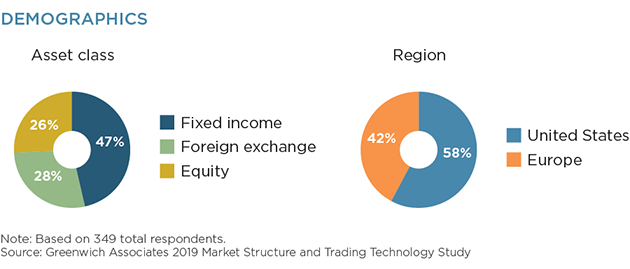

MethodologyGreenwich Associates interviewed 349 buy-side traders across the globe in Q4 2019 working on equity, fixed income or foreign exchange trading desks.