Corporate bond market structure has shown its resilience in 2020 like never before. Even in the most volatile days, before the Federal Reserve stepped in and the migration to working from home was just beginning, volumes surged, the largest trading venues kept pace, and dealers kept providing liquidity. While the Fed’s intervention certainly leaves many feeling like the market could not find its way, market functioning in the face of unprecedented risks and impossible-to-know outcomes would not have been possible had the last decade’s innovation never taken place.

But as the world and the market both work their way out of the depths of the crisis, the corporate bond market is turning its attention to what can be done to improve markets and market structure going forward.

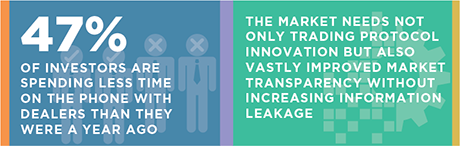

Improving market transparency for both liquidity providers and investors is certain to be on the list, albeit in a way that does not create new information leakage nor discourage dealers from providing much needed liquidity. New data that helps determine the location of every bond and reveals how dealers are sourcing liquidity are good examples.

Further, corporate bond dealers must continue down the path of digitizing their franchise—not just via more electronic execution, but also by utilizing technology to inject more efficiency into every part of their business. This will require not only more data, but a new way of putting that data to work (think artificial intelligence)—something the market has been working on for years, but must continue to emphasize.

A foundation now exists where all market participants appreciate the value technology can bring to their franchise and the market as a whole. And while some still resist the “new way” and dream of the “old days,” the new way is now the only way forward. At the risk of sounding cliché, those that embrace new ideas while still maintaining key relationships will continue to be the most successful.

MethodologyIn Q4 2019, Greenwich Associates interviewed 349 buy-side traders in the Americas and EMEA working on equity, fixed-income or FX trading desks.

Respondents were asked a series of questions focusing on changes in market structure, including electronic trading. We also incorporated results from the 2019 Greenwich Associates U.S. Fixed-Income Investors Study, which asks nearly 1,000 U.S. fixed-income traders and PMs about their trading activity and quality of service received by their dealer counterparties. Finally, senior analysts at Greenwich Associates conducted a series of in-depth phone interviews with market participants to provide additional color.