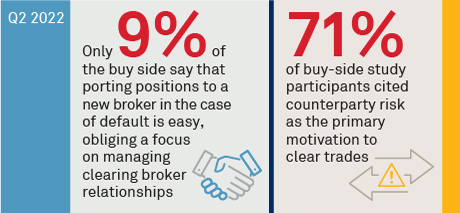

The derivatives market continues to evolve. Over the past few years, the industry has experienced volatility, spikes in volume and other stresses. These events, coupled with continued regulation, inform market participants’ strategic decision-making. These decisions are meant to help balance costs, risks and the ability to execute trading strategies. Asset managers and brokers will constantly reexamine their processes, technologies and relationships. The incentives will keep pushing more volume through CCPs, ensuring the buy side will continue to focus on managing and optimizing their panel of clearing brokers.

MethodologyThis report is based on data and insights collected from 182 global derivatives market participants between October and December 2021. Respondents include asset managers, hedge funds, broker-dealers, clearing firms, proprietary trading firms, exchanges, clearinghouses, and other industry participants. Questions focused on their habits, opinions and expectations for the global derivatives markets in the next three to five years. Coalition Greenwich collaborated with FIA to both develop the questionnaire and to gather responses from industry participants.