The technology innovation of the past decade has improved corporate bond liquidity. It’s hard to remember that not long ago corporate-bond market-structure chatter was all about the “liquidity problem.” One would be hard pressed to argue that market liquidity isn’t better than it was at the start of the millennium, and all signs point to it only improving further in the coming years.

Even so, the world’s biggest bond dealers still rely heavily on the same methods of working a trade as they have for decades. This suggests that while those mechanisms clearly remain incredibly effectively, room for new innovation still exists in this market that has already moved forward so dramatically.

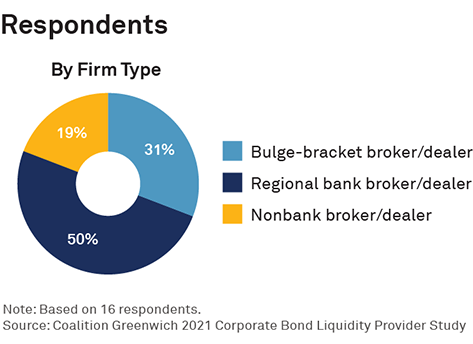

MethodologyThis flash study was conducted in June 2021. The 16 respondents included global investment banks, regional/middle-market banks and nonbanks all providing liquidity in the U.S. corporate bond market. Questions focused on current approaches to trading with clients, areas where liquidity providers should invest, areas where liquidity venues should invest, and the state of market liquidity since the start of the pandemic.