Japanese fixed-income investors may consider revisiting some long-established trading practices after the Bank of Japan (BOJ) took what could be the first small step toward unwinding its near decade-long policy of ultra-low interest rates.

In December, the BOJ raised the cap on benchmark 10-year government bond yields. Many in the market saw the move as a possible test or even the beginning of what could be a move toward monetary tightening. About 90% of the economists participating in a November 2022 poll by Reuters1 expect the BOJ to unwind its policy of monetary easing, with almost half of respondents predicting that the central bank could start that process in 2023.

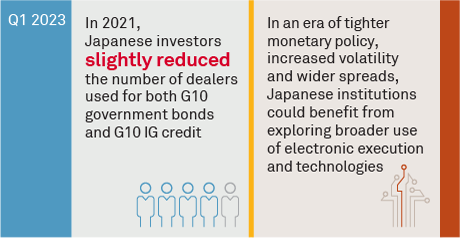

The repercussions from the BOJ action could prompt Japanese fixed-income investors to reassess not only their portfolio strategies, but also the practices and mechanisms they use to trade and source liquidity in fixed-income products. For example, faced with the prospect of more challenging market conditions, Japanese investors might start examining the length and depth of their fixed-income counterparty lists.

MethodologyBetween February 2021 and March 2022, Coalition Greenwich conducted interviews with over 1,000 fixed-income investors globally. Topics included dealer relationships, volume allocation factors and use of electronic trading.