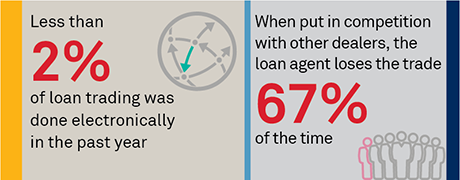

Loan markets have been busy this past year. But despite the uptick in issuance, trading volume and investor demand, trading of par and leveraged loans remains largely manual. By most accounts, today’s loan market looks the same as the corporate bond market did 20 years. Some trading via request-for-quote (RFQ) exists, but the majority of trading is done via the phone, and most pricing data comes from scraped chat messages.

Past attempts to inject technology into this critical market have largely failed, but following a technology surge at the hands of working from home in 2020, change now feels possible. For instance, electronic trading in high-yield bonds jumped to over a quarter of the all-to-all market in 2020, a level that only five years ago felt impossible.

Further, traders forced to work somewhere other than near their trading assistants and operations teams quickly realized electronically trading orders made their life a whole lot easier. And we can’t forget about the newfound maturity of distributed ledger technology (DLT), now well positioned to help the loan market’s complex settlement process.

Markets do not, of course, electronify overnight. Even with the right technology and market participant willingness, such behavioral change takes time. Loans markets bring their own set of market-structure complexities that require solutions not found in other fixed-income markets—incentives to trade with the loan agent, two-week settlement times and a lack of consistent market data.

Based on our research and conversations with loan market participants, we believe the willingness to change this market now exists and the technology needed to improve the end-to-end workflow is ready for prime time.

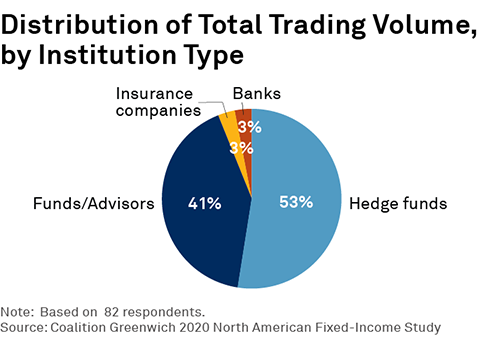

MethodologyThis research is based on conversations with 82 institutional loan investors in the United States in 2020. Interviews were also conducted with loan agents, dealers and electronic-trading platforms in the spring of 2021. Conversations focused on the current market structure for trading and investing in leveraged loans, and expected adoption of new technology and electronic trading in the coming years.