Executive Summary

We have examined in previous years a variety of structural issues in the swaps market that discourage new entrants from stepping into the fray. The capital intensity of the business is the primary one, but details being debated this year as swaps trading rules are in flux-such as post-trade name give-up, the ability to trade via "any means of interstate commerce" and moving toward a market where RFQ to 1 is explicitly permitted-are worthy of deeper examination.

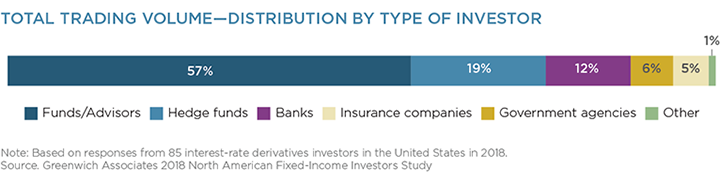

MethodologyIn the first half of 2018, Greenwich Associates conducted interviews with 85 interest-rate derivatives investors in the United States as part of its annual North American Fixed-Income Investors Study.