The need for more and better analytics to deal with fixed-income data has arrived. As the volume of information linked to bonds has grown, investment firms are looking for new and improved ways to manage that information and gain insights from the data they consume.

One area that has benefted from the onset of innovative tools is pre-trade analytics. Buy-side frms are turning to evaluated pricing and advanced technology to help them find liquidity and navigate a host of macroeconomic factors, including enhanced volatility, higher rates, infation, and other frictions.

This report focuses on our recent study, which was designed to foster a better understanding of the evolving role of data and technology being used by buy-side investment frms.

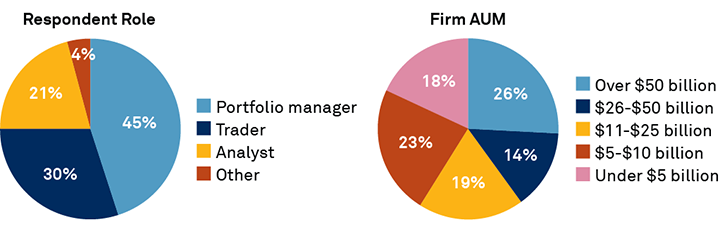

MethodologyBetween July and August 2022, Coalition Greenwich conducted a study to better understand the evolving role of data and technology in fixed-income investing across the buy side. Study participants included portfolio managers, traders and analysts from 111 firms in North America, Europe and Asia-Pacific. Additionally, qualitative discussions were held with a dozen buy-side market participants to evaluate trends and future strategy. Participating firms were mostly large, experienced shops with $50 billion in AUM or higher. Medium- and smaller-sized shops were also well represented.