In late September 2020, the U.S. Securities and Exchange Commission (SEC) adopted amendments to modernize Exchange Act Rule 15c2-11.1 Last overhauled some 30 years ago, the Commission recognized the need to update the regulation to account for changes in communication methods and make information related to over-the-counter (OTC) securities more timely and transparent. The rules were originally intended to protect retail investors from fraudulent behavior in the trading of OTC stocks (i.e., the “pump and dump” schemes of the 1990s). In this recent announcement, however, fixed-income securities, which are nearly all traded OTC, would now be in explicitly in scope.

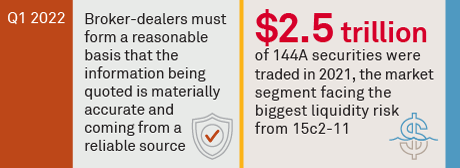

At the heart of the amendment, broker-dealers are no longer permitted to publish quotations (i.e., quote a price to buy or sell) for an issued security when an issuer’s information is not publicly available and current—albeit, with some exceptions. Thus, the rule is not actually focused on the trading of fixed-income securities, but, instead, deals with broker-dealers publishing quotations in a quotation medium—effectively a bid or offer to trade. While there is clearly a legal difference between quoting and trading, the linkage between the two can’t be ignored in today’s corporate bond market structure.

MethodologyIn Q1 2022, Coalition Greenwich conducted conversations with market participants, regulators and trading platform providers to discuss SEC Rule 15c2-11. Topics included technology solutions, operational challenges and potential market impacts going forward.