E-trading is appealing to resource-constrained investors and brokers alike. But content demands keep the majority of trades flowing through high-touch channels. It is important not to interpret the...

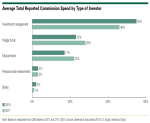

For the first time in five years, U.S. equity commissions are up 10%—a trend Greenwich Associates predicts will continue through 2014. In a low-volume trading environment, the rise is the...

While the bulge bracket continues to see the majority of trade flow, Greenwich Associates data shows a strong trend toward mid-tier brokers for both execution and research. Despite seeing a decline...

This report provides detailed information on the top performing U.S. equity traders and research professionals.

This report provides detailed information on cash compensation information for buy-side equity analysts in the U.S. Compensation information is broken down by portfolio size, type of...

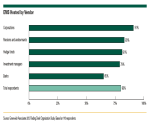

Cloud computing applications, like vendor-hosted execution management systems (EMS) and Software as a Service (SaaS), are common on Wall St., but most finance firms are underutilizing this resource...

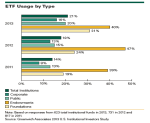

Greenwich Associates expects both usage rates and allocations to broaden as institutions embrace ETFs for an expanding number of applications and asset classes, and as ETF providers continue to...

As part of our annual equity investor study, Greenwich Associates asks how much volume investors are currently trading electronically and how much they expect to trade in the coming three years...

FX and fixed-income markets are both changing, but that is where the similarities end. Greenwich Associates research shows that buy-side demands and regulations impacting sell-side business models...

This report provides detailed information from institutional investors in Asia, including helpful benchmark on externally managed assets by:

Type

Country

Size of fund

Pages

Need to Contact Us ?

We are always here to help you

What We Offer

Our experts are happy to help you with your specific research needs. Schedule a consultation