About one in five companies plans to reduce capital expenditures below expected levels for 2023 and almost 90% of those companies plan to reduce borrowing, including 15% of businesses planning to...

The corporate bond market proved particularly resilient amid March’s bank-induced market stress. Volumes remained above those in 2022, averaging $40 billion traded per day (including investment grade...

The average daily trading volume for U.S. Treasuries in March hit its highest level since March 2020, trading $863 billion per day (compared to $944 billion in March 2020).

FY22 Coalition Index Investment Banking revenues fell (13)% on a YoY basis.

IBD: Shrinking M&A pipeline and declining origination led to the lowest revenue in a decade (following a strong...

FY22 revenues for the Commercial Banking Index banks increased significantly YoY, driven primarily by Cash Management which was supported by an increase in Trade Finance and Lending. This was...

This Greenwich Report explores several drivers of investment in surveillance technology. These range from the system upgrades via new technology, better data, more analysis tools and methods, and...

In 2022, inflation, rising interest rates and other macroeconomic headwinds replaced pandemic disruptions as the key challenges facing institutional investors in Japanese equity markets.

Many...

Transaction Banking Revenues reached a decade high in FY22, driven by robust growth in Cash Management, while Trade Finance grew moderately. The second half performed better than first half,...

This report provides ranking information on the asset managers employed by institutional investors in Europe based on the service and quality they deliver to their clients.

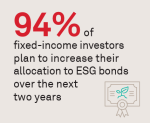

Environmental, Social and Governance (ESG) is one of the more ubiquitous topics in asset management, yet inconsistencies around taxonomies, data and regulation impact the investment process....

Pages

Need to Contact Us ?

We are always here to help you

What We Offer

Our experts are happy to help you with your specific research needs. Schedule a consultation