In U.S. equities the main priority is getting paid for what you deliver. By maintaining their trading share, some of the bulge bracket banks are now punching above their weight class in terms of...

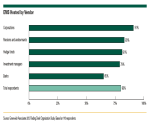

While notional trading volumes of interest-rate derivatives saw a sizeable increase globally in 2013, corporate users continue to do the bulk of their business with a narrow list of dealers....

This report provides detailed sector ranking information from buy-side equity analysts in the United States. This report provides rankings of the best sell-side analysts across 55 GICS-based sectors...

E-trading is appealing to resource-constrained investors and brokers alike. But content demands keep the majority of trades flowing through high-touch channels. It is important not to interpret the...

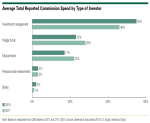

For the first time in five years, U.S. equity commissions are up 10%—a trend Greenwich Associates predicts will continue through 2014. In a low-volume trading environment, the rise is the...

While the bulge bracket continues to see the majority of trade flow, Greenwich Associates data shows a strong trend toward mid-tier brokers for both execution and research. Despite seeing a decline...

This report provides detailed information on the top performing U.S. equity traders and research professionals.

This report provides detailed information on cash compensation information for buy-side equity analysts in the U.S. Compensation information is broken down by portfolio size, type of...

New

Cloud computing applications, like vendor-hosted execution management systems (EMS) and Software as a Service (SaaS), are common on Wall St., but most finance firms are underutilizing this resource...

New

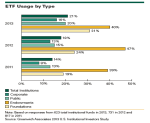

Greenwich Associates expects both usage rates and allocations to broaden as institutions embrace ETFs for an expanding number of applications and asset classes, and as ETF providers continue to...

New

Pages

Need to Contact Us ?

We are always here to help you

What We Offer

Our experts are happy to help you with your specific research needs. Schedule a consultation