Descriptions of the foreign-exchange market tend toward the cliché. First, it’s inevitably highlighted as the largest market on Earth, turning over $5 trillion a day. Second, most note that it trades the longest—24 hours a day, almost seven days a week.

The discerning might point out that its international nature has also made it one of the freest, with each leg of every transaction subject, at least in part, to the laws of different states. The historically minded might say it’s the oldest, with references to “moneychangers” going back to the bible and Herodotus.

To this list of superlatives, FX market structure enthusiasts might be tempted to add another: It’s got the richest diversity of execution choices. Within the FX market structure, any given customer can choose among a plethora of counterparties and trading protocols, many of which exist in other markets—but few markets have them all. Based on the results of our most recent study, this paper explores how market participants go about choosing among them.

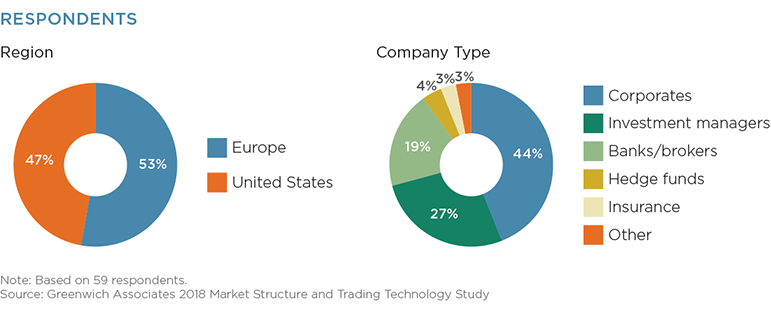

MethodologyThroughout June and July 2018, Greenwich Associates interviewed 59 FX investors as a part of the annual Market Structure and Trading Technology study. Respondents were asked how they select an FX trading platform, how they determine quality execution as well as the influences of selecting an FX algo.