Corporate treasury, the guardian and anchor of the financial health of the corporation, is undergoing significant change. Greenwich Associates has conducted a study of corporate treasurers from major multinationals and other corporations and looked at how their roles are changing and how they are adapting. Key performance indicators (KPIs) for the great majority of treasury departments have changed over the past five years. Treasurers are being asked to look further forward into the future and upward to address more strategic concerns. They are seen as centers of analytic excellence and are being asked to play a role in transforming as well as securing the firm.

This is clear from what treasurers say and do. They have been increasingly focused on projects and one-off assignments at the behest of management, rather than the day-to-day management of the treasury department. These projects are driven by strategy, risk or by the need to routinize the processes of treasury in order to free up more time to focus on strategy and risk.

Though managing and measuring risk rank highly among treasurers' priorities, there is little consensus around what constitutes best risk management practice. The nature of the risks that firms take on, and how their stakeholders prefer those risks be addressed, varies significantly across firms. Treasury departments are working steadily to improve their risk management techniques as well as the data that drive them.

Technology thus presents both an opportunity and a challenge. Many treasury departments are heavily dependent on spreadsheets. These can be unwieldly and difficult to integrate with data sources. Treasurers must decide how they invest in improving these processes. Properly leveraging technology is becoming a central task for treasurers, from automating routine processes to using third-party tools to enhance internal risk analysis. The fact that there is not a one-size-fits-all solution to the challenges facing treasury departments means that their technology must be increasingly flexible.

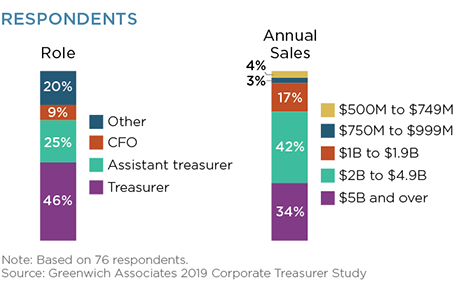

MethodologyGreenwich Associates conducted electronic interviews with 76 corporate treasury executives from large, industry-leading multinationals based in the United States to explore the evolving role of the corporate treasurer. The interviews were conducted in the second half of 2019. Topics covered in the research included how corporate treasurers’ objectives are defined, what methods and tools they use to achieve those objectives, and where there may be shortcomings in the tool set. In addition, we conducted several qualitative interviews via in-depth conversations in order to dive more deeply into how specific corporate treasury staff manage their risks. This paper is produced in partnership with Bloomberg.