Table of Contents

The electronic trading landscape is changing quickly. MarketView’s timely, data-driven insights will help you stay ahead of the market structure evolution.

The growth of electronic trading and regulators’ push for more transparent markets have increased the availability of high-quality market data. However, gathering, normalizing and making sense of that data remains a challenge.

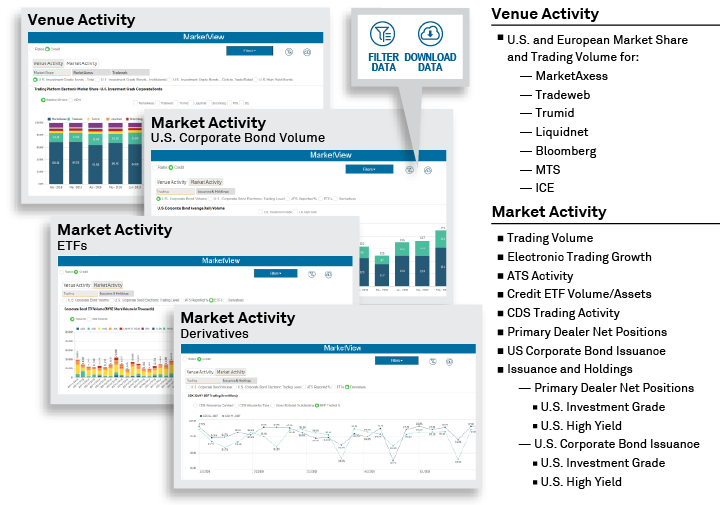

MarketView combines unique research from Coalition Greenwich, publicly available market data and the insights of our analyst team to quantify the growth of electronic trading in fixed-income and FX markets. The results include trading-platform market share and electronic trading trend data with a level of accuracy not available anywhere else.

Our list of customers includes sell-side traders, buy-side traders, trading-venue strategists, product managers and buy-side equity analysts covering the progress of global exchanges and trading venues.

Greenwich MarketView Rates Data

Greenwich MarketView Credit Data

2025 Data Spotlight: U.S. municipal bond trading in 2025 by the numbers

January 2026

2025 Data Spotlight: U.S. Treasury trading in 2025 by the numbers

January 2026

U.S. Treasury trading in 2025 was defined by record volumes and the lowest average volatility since 2021.

2025 Data Spotlight: U.S. corporate bond trading in 2025 by the numbers

January 2026

U.S. corporate bond trading averaged over $50 billion per day in 2025 for the first time ever, improving 11% from its previous record in 2024.