Table of Contents

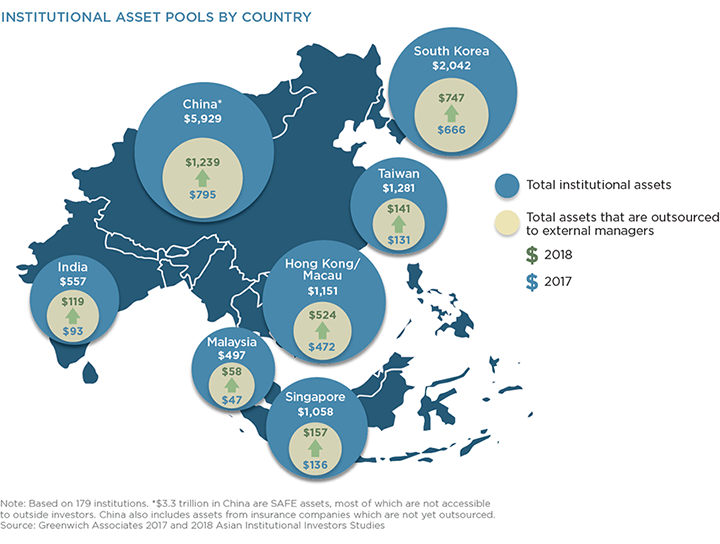

Institutional assets available to asset management firms in Asia topped $3 trillion for the first time this year, as central banks, large pension funds and other institutional investors continued diversifying their portfolios and outsourcing assets. But the good news for asset managers does not end there. Not only are Asian institutions outsourcing more and hiring more external managers, they are allocating these assets to higher-risk asset classes with higher fees and better margins for managers.

Greenwich Quality Leaders

Among the biggest beneficiaries of these favorable market conditions are Allianz Global Investors, Invesco and PIMCO, the 2018 Greenwich Quality Leaders℠ in Overall Asian Institutional Investment Management. “These three managers have made a firm commitment to this market and to providing institutional clients here with the highest quality investment platforms and client service,” says Greenwich Associates Managing Director Markus Ohlig. “As a result, they have built strong relationships with key Asian institutions that are now paying off.”

Asset Managers Benefit from Growing Risk Appetite

As Asian institutions continue amassing assets, they are shifting funds out of the domestic asset classes that have traditionally made up the bulk of their portfolios. This trend, which started among the region’s 10–12 largest institutions, has now gained traction among the broader group of large institutional investors, which number upward of 50.

Several factors have contributed to this trend. For starters, low interest rates have set investors around the world on a search for yield and attractive investment returns. Asian institutions, which until recently had been weighted heavily to fixed-income and domestic assets in their portfolios, have experienced an increase in risk appetite. This new demand for risk has arisen at a time when many Asian countries are loosening rules that, in some cases, severely limited institutions’ ability to invest in certain asset classes and non-domestic assets.

As recently as 2010, fixed income made up approximately three-quarters of overall Asian institutional assets. In 2018, fixed income represents just 46%. Institutions have made dramatic cuts in domestic fixed income, which declined to an average 26% of total assets in 2018 from 36% in 2010. These assets are being reinvested in international equities, which increased to 26% of total asset in 2018, up from only 8% in 2010.

Largely as a result of these shifts as well as strong equity market performance, the total amount of outsourced assets increased 13% last year to more than $3 trillion. That growth has fueled an increase in new manager hires in alternative asset classes and real estate, even as hiring in fixed income has plateaued.

Shifting to Passive Strategies in the Core

If there is one negative trend facing asset managers in Asia, it is institutions’ continued move into passive strategies for core investments. In 2017, 72% of Asian assets were invested in active strategies; in 2018 that share plunged to 56%.

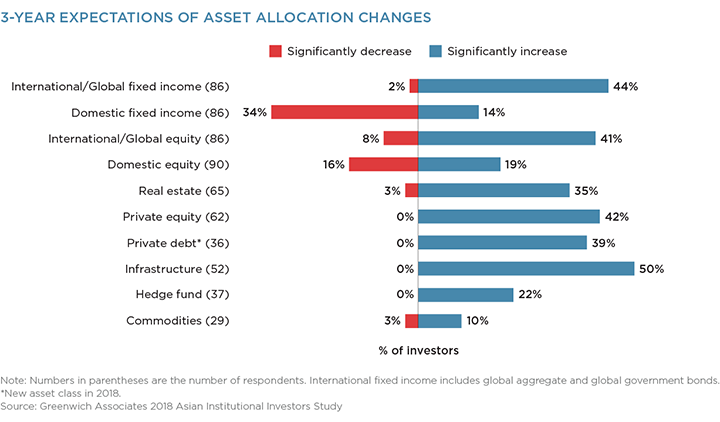

The impact of that shift for managers as a group is being offset somewhat by institutions’ increasing appetite for higher-risk, specialty and alternative asset classes that carry significantly higher fees. In that regard, institutions’ plans for their portfolio allocations are truly eye-popping. Half of all institutions participating in the 2018 Greenwich Associates study say they plan to significantly increase allocations to infrastructure in the next three years. That share is 42% in private equity, 39% in private debt and 22% in hedge funds. In all these categories, not a single institution plans to make meaningful cuts to allocations.

“These allocation shifts play to the strengths of firms like AGI, Invesco and PIMCO, all of which are able to deploy some combination of investment prowess, access to higher-risk or specialty products and value-added client service to help institutions plan, execute and manage these new investments,” says Greenwich Associates consultant Parijat Banerjee.

SRI on the Rise

Around the world, socially responsible investing (SRI) is becoming a serious consideration for institutional investors in both their investment and manager hiring decisions. On this topic, Asian institutions are taking a more measured approach than their counterparts in Europe, who are at the forefront of this movement.

More than half of European institutions say they include SRI as an important criterion in their manager selection process. In the Netherlands and some Nordic countries, that share tops 95%—and in most of Europe those numbers are rising quickly.

The trend has been much slower to take hold in Asia, where about a third of institutional investors say SRI plays an important role in their manager selection process. However, in Asia and around the world, we expect SRI to continue growing in importance in both manager selection and institutional investments.

Managing Director Markus Ohlig and consultant Parijat Banerjee advise on the investment management market in Asia.

MethodologyBetween January and March 2018, Greenwich Associates conducted 144 interviews with the largest institutional investors in Asia. Senior fund professionals were asked to provide detailed information on their investment strategies, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of those managers soliciting their business. Countries and regions where interviews were conducted include Brunei, Cambodia, China, Hong Kong/Macau, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, and Thailand.