This report presents the results of a Greenwich Associates study of U.S. insurance company investments in exchange traded funds (ETFs). We interviewed 52 insurance companies, with total assets of approximately $1.9 trillion, in September and October 2018. The central conclusion: Usage and overall investment in ETFs is increasing as insurance companies introduce them to general account portfolios and expand allocations.

Over the past decade, use of ETFs in insurance general accounts has grown both in terms of assets and portfolio applications. A major tailwind for insurers looking to use ETFs in their general accounts came in April 2017 when the National Association of Insurance Commissioners (NAIC)—the insurance industry’s chief regulatory body—announced their decision to allow insurers to apply the bond-like treatment of “systematic value” to fixed income ETFs for accounting purposes. This new ruling has greatly increased the attractiveness of fixed income ETFs to insurers and is already resulting in increased investments.

The study further reveals that insurers are investing broadly in ETFs in general accounts, across both equity and fixed income portfolios. Sixty-two percent of study participants are using ETFs, most commonly for optimization of asset allocation, construction of low-cost core equity portfolios and the elimination of cash friction. However, the uses for ETFs in insurance general accounts do not stop there: Greenwich Associates has identified 12 distinct portfolio applications for insurers.

Regulations will continue to play a large role in how insurers use ETFs. Looking ahead, a majority of the study participants expect the regulatory environment to become more favorable for ETFs. That outlook likely contributes to the fact that more than 60% of current ETF investors expect to increase their ETF allocations in the next three years, and 82% of non-users expect their organizations to reconsider investing in ETFs over the same period.

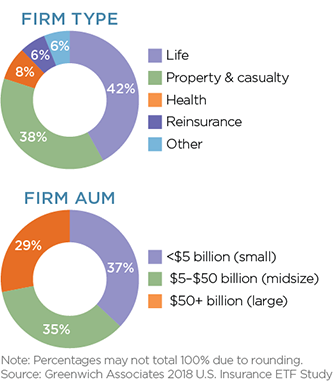

MethodologyGreenwich Associates conducted 52 interviews with insurance companies in the United States about their use of ETFs. Most study participants were life (42%) and P&C (38%) companies, although the research sample also included representation from health and reinsurance. With total assets of approximately $1.9 trillion, participating companies were fairly evenly split across small (<$5 billion), midsize ($5–50 billion) and large (>$50 billion) insurers. Interviews were completed in September and October of 2018.