Table of Contents

Amid continued disruptions from the COVID-19 crisis and concerns about mounting inflation, U.S. asset owners leaned more heavily on the advice of their investment consultants last year. The 2021 Greenwich Quality Leaders in U.S. Investment Consulting stood out for their superior support for clients working to navigate fast-changing markets.

By many counts, 2021 was a great year for asset owners. Surging equity returns helped lift pension funding levels, with average funding increasing to 96% in 2021 from 92% in 2020 among corporate funds, and to 81% from 79% among public funds. As of year-end, 39% of corporate funds and 12% of public funds reported funding levels of at least 100%.

Trusted Advisors in an Uncertain Environment

These relatively favorable conditions helped alleviate anxieties about market volatility, rates of return, funding issues, and risk management. However, with the coronavirus Omicron variant spreading through the United States, continued chaos in global supply chains and inflation accelerating at a dangerous pace, asset owners were not resting easy last year. Fifty-five percent of asset owners cited asset allocation in the uncertain environment as a top challenge, and the share naming inflation as a major concern surged to 17% in 2021 from just 4% in 2020.

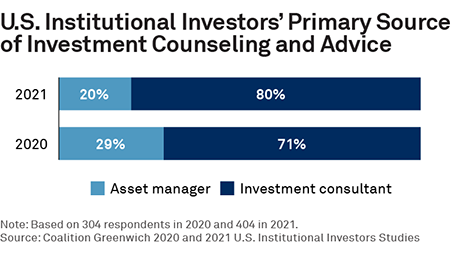

As they updated investment strategies in these changing conditions, 80% of asset owners relied on their investment consultants as their primary source of advice. That’s an increase from the 71% who named consultants as their top source of investment counsel and advice in 2020. Investment consultants are also playing an active role in advising asset owners on ESG. Half of U.S. asset owners in North America have adopted some environmental, social and governance standards, up from just 27% in 2019. These institutions are still determining how to implement ESG throughout their operations. Consultants are helping asset owners work through thorny issues like how to integrate ESG into their manager selection process and how to pick the right ESG data providers.

2021 Greenwich Quality Leaders

The following tables present the complete list of 2021 Greenwich Quality Leaders in U.S. Investment Consulting.

Davis Walmsley, Todd Glickson, Susan Gould and Joseph Mattesi advise on the investment management market in the United States.

MethodologyBetween July and October 2021, Coalition Greenwich conducted interviews with 811 individuals from 661 of the largest tax-exempt funds in the United States. These U.S.-based institutional investors are corporate and union funds, public funds, and endowment and foundation funds, with either pension or investment pool assets greater than $150 million. Study participants were asked to provide quantitative and qualitative evaluations of their asset management and investment consulting providers, including qualitative assessments of those firms soliciting their business and detailed information on important market trends.