Executive Summary

Over 80% of OMS users and 90% of EMS users are working with third-party systems today. After nearly three decades of development in some cases, the quality of the commercially available options creates a still hard-to-match ROI calculation. Equity and fixed-income desks utilize different OMS and EMS providers as each provider has its sweet spot, although given recent M&A activity, this may not always be the case.

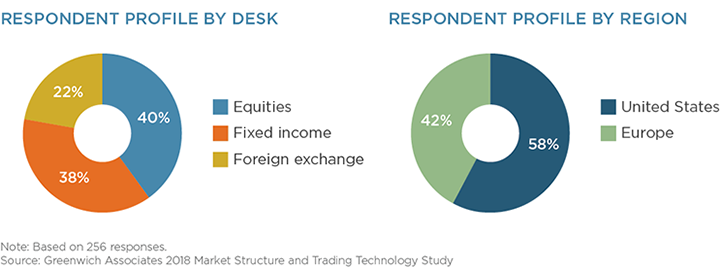

MethodologyGreenwich Associates interviewed 256 buy-side traders in the United States and Europe in the fourth quarter of 2018. Questions focused on their use of order and execution management systems, examining usage, plans to change, and how they expect the market to develop over time.