The global financial crisis of 2008 drove a massive reexamination of how the market and its participants operate. The more recent focus on environmental, social and governance (ESG) metrics by investors and their counterparties has accelerated efforts to ensure financial firms operate not only profitably, but also in a manner that conveys commitment to remaining compliant both in practice and spirit.

The explicit and implicit costs of failing to build a compliance program that supports both the firm and employees in meeting regulatory standards can be dire, and awareness of reputational risk has shifted into prominent focus in recent years. Financial firms have stepped up their adoption of compliance processes and technology, but many still operate on a web of disparate legacy systems, thus increasing the possibility of avoidable missteps. The siloed nature of compliance has made it harder for some firms to upgrade their technology even when the interest is there. The rise in remote working, which is likely here to stay in the post-pandemic era, is compounding this problem.

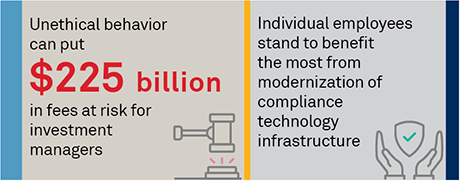

Coalition Greenwich estimates that the potential loss of assets from ethical missteps by investment managers could translate to upwards of $225 billion in fees going to competitors. And this does not include the risk of hard dollar fines levied on both firms and individuals or the increasing personal liability placed on senior management, evidenced by the incarceration of some resulting from recent market scandals.

Worse, failure to upgrade systems that educate and support employees in upholding even some basic requirements can lead to disproportionate levels of individual risk. In absolute terms, consequences for individuals appear small compared to those for firms, but they are much higher in relative impact. The most devastating effects of compliance failures are often borne by employees, not firms, and stem from cases rarely publicized in the media.

This report examines how financial services firms are working today to encourage an ethical culture, and the steps being taken to overcome challenges in improving legacy approaches.

MethodologyIn the second quarter of 2021, Coalition Greenwich conducted in-depth interviews with more than a dozen financial markets professionals to discuss their current attitudes and approaches toward compliance management—its importance to the business over all, how processes are changing and the technology needed to succeed going forward. Topics included current and future spending, hiring trends, concerns with existing processes and technology solutions, and expectations for compliance management needs going forward. Coalition Greenwich data based on broad market outreach with the buy and sell side examining marketwide spending and system usage trends was also used in this analysis.