Table of Contents

Executive summary

A healthy derivatives market is an important element to Japan’s plan to become a global leader in asset management. Asset managers are eager to increase their use of derivatives to better take and manage risk, but note that there is an opportunity to make the market more accessible. Discussions with 20 senior asset managers based in Japan revealed that reducing barriers in the market would enable them to utilize derivatives more efficiently, which, in turn, could enhance Japan’s competitiveness in the global market.

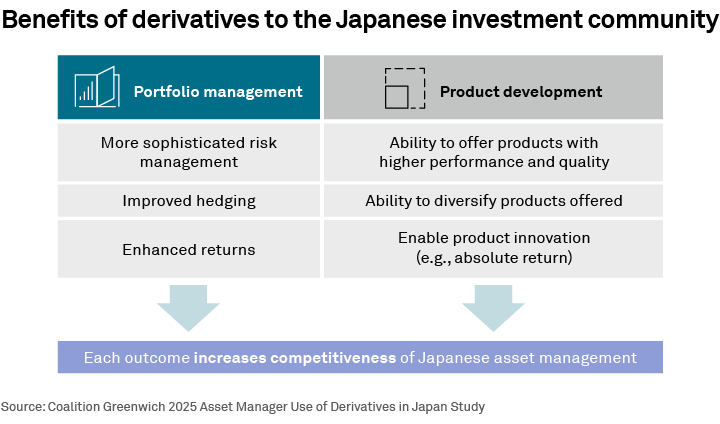

Nearly 80% of respondents indicated that derivatives are currently important to help achieve their strategies and objectives, and also mentioned that derivatives usage benefits both portfolio management and product development. Therefore, they are looking to improve how they trade and process derivatives.

Portfolio managers will need to respond to the changing macroeconomic environment and look to the derivatives market to help manage the implications of potential drivers such as interest rate changes. They may add derivatives to an existing strategy or launch new investment products. Either way, a robust market is necessary to ensure that portfolio managers succeed on behalf of their clients.

Introduction

Derivatives are vital instruments used across the global economy by a variety of market participants, including investment professionals, corporations and, increasingly, retail investors. The market’s diverse universe of products and access methods allows these and other users to find the right products for their different needs. The derivatives market is enormous—$548.3 trillion at the end of 2024 for interest-rate derivatives alone.1 It has been a mainstay in capital markets for decades and enabled successful outcomes for numerous investment strategies, as well as risk management through hedging.

Although the derivatives market is global, regional and country-specific nuances influence the use of different instruments. In Japan in particular, issues such as the current ecosystem of electronic trading and processing, derivatives clearing, and regulation have impacted how derivatives can be used, which has slowed widespread adoption. In the recent past, the level of derivatives use in Japan was lower than other countries. Globally, there was $5.77 trillion in interest-rate derivative (IRD) turnover on a net-gross basis, according to the 2022 BIS Triennial Survey. Of this, only 1%, or $51 billion, was based in Japan, compared to 29% based in the United States.2 Japan has a higher proportion of FX activity, with 4% of turnover of a net-gross basis compared to 19% in the U.S., according to the same survey.

That said, there have been significant improvements to the market structure in recent years. For example, according to the Japan Securities Clearing Corporation (JSCC), the number of cleared interest-rate swap (IRS) trades increased nearly 20% between 2023 and 2024, while notional of cleared interest-rate trades more than doubled during that same time.3 In that vein, the derivatives professionals that participated in this study advocated for continued market structure evolution that will further the goals of Japanese businesses and support the aspirations of the Japanese government’s asset management strategy—Policy Plan 2.0 for Promoting Japan as a Leading Asset Management Center.

The macro environment in Japan and derivatives

Japan has experienced some notable macroeconomic factors, such as an aging population and low or negative interest rates that have not only influenced investment allocations but also affected the trajectory of the derivatives market. Over the years, these factors likely slowed derivatives use, as the need to hedge in the zero-interest rate environment was limited. Low volumes meant that there was little incentive to invest in creating scale; manual execution and processing were not ideal but sufficient during that time.

Although the market may have evolved more slowly than in other regions, derivatives have proved to be resilient and necessary tools, as some asset managers have overcome limited expected returns from investments in Japan government bonds (JGBs) to generate yield via the derivatives market. With macroeconomic conditions changing, the need for derivatives increases, and the Japanese market will benefit from a robust infrastructure to absorb this new demand.

Our research indicates that investment management market participants in Japan use derivatives for similar reasons as their peers in other regions: hedging, risk management (including currency risk and interest rate risk) and, sometimes, alpha generation.

The ability to diversify sources of returns and mitigate sources of risk allows for more flexibility in how assets are managed, which can, in turn, reduce costs while improving performance. Although lingering concerns about the riskiness of derivatives remain as a result of the global financial crisis, they have proven over time to be useful tools that continue to provide benefits to investors and corporations alike.

The Japanese government is focused on the future and competitiveness of its asset management industry in order to increase the flow of capital into investment products. Through the government-led asset management strategy initiative, officials recognize the need for the asset management sector to continue to evolve.

Japan’s evolution into an asset management center will take multiple forms, and derivatives usage is well-positioned to play a role in this change. As a matter of fact, 89% of market participants in our study agreed that the increased use of derivatives supports the asset management strategy, both indirectly and directly. Senior market participants assert that the benefits of increased use of derivatives will improve portfolio management and enhance their product development.

Derivatives in Japan—What can be improved?

Our research confirms that 90% of professional investors at asset management and asset owner firms in Japan see value in increasing their use of derivatives. Our interview participants also mentioned several issues that sometimes constrain their use of derivatives. Some are endemic to derivatives trading globally; others are more pronounced in Japan. Prominent themes include an uneven ability to source liquidity across certain products, the need for more electronic execution and processing, a desire to clear more trades, regulatory considerations, and lack of local derivatives expertise.

Uneven liquidity in some market segments: Our respondents cite the lack of liquidity in certain instruments as an impediment. Yen swap liquidity is generally thought to be sufficient in most instances, but some desks report they have difficulty or that they are hesitant to transact in less vanilla instruments, such as certain credit-default swaps and OTC options on JGBs because they are thinly traded, and they might not be able to easily reduce or trade out of their exposures. Liquidity, of course, requires participation, and increased participation by the buy side in the next few years could naturally improve liquidity.

Automation of trading and operational processes: Electronic trading and processing for the global derivatives markets is progressing. The last decade has seen derivatives trading around the world start to transform from a phone/chat-based network into a more sophisticated electronic ecosystem with tools to automate the workflow. This transformation is still in process.

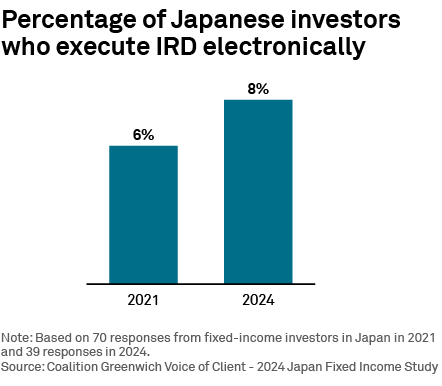

The number of firms trading derivatives electronically in Japan remains low relative to other major markets. According to our research, only 8% of Japan-based asset management firms traded IRD electronically in 2024—meager growth from 6% in 2021.

By contrast, our data shows that 75% of firms in the U.S. and 71% in EMEA traded electronically in 2024. Users in those regions more frequently access multiple protocols (e.g., RFQ, streaming prices), tools and venues, which help optimize trade execution. The uneven liquidity is one driver of lower e-trading usage.

The lack of fully electronic processing across the trade life cycle is a concern for the industry and a reason participants advocate for increased e-trading. Manually executed trades will be manually input into middle-office systems, which makes processes such as reconciliation, pricing and collateral management more error-prone and expensive. Trust banks, which are hired by asset managers for services such as the safekeeping of assets, fund administration, fund accounting, and other operational processes, sometimes lack the capacity and infrastructure to accommodate derivatives trading at scale. A lack of expertise in these processes and the technologies that support them add operational risk to a product that already contains market, credit, liquidity, and other risks.

Building on the significant progress in clearing: After the global financial crisis in 2008, there was a significant and successful push to clear as many swaps as possible. Additional regulations continue to be phased in to further incentivize or require clearing. The most recent regulatory push for more clearing came from the Uncleared Margin Rules (UMR) that were phased in through 2022, increasing the collateral costs of holding uncleared swaps.

While there have certainly been notable clearing successes in Japan, respondents noted three issues. First, at the time the interviews were conducted, the JSCC had not been recognized as a Derivatives Clearing Organization (DCO) in the U.S. This regulatory barrier meant U.S. asset managers in Japan and elsewhere so far could not clear through the JSCC. Recently, the CFTC has allowed non-U.S. clearing members of JSCC to clear JPY interest-rate swaps for U.S. customers under certain conditions.4

Second, the JSCC and LCH clear different yen swap activity, resulting in pricing discrepancies that can mean higher costs for market participants. Finally, as in other regions, asset managers also hope to see more products, such as cross-currency swaps, become eligible for clearing.

Managing regulatory considerations: Two regulatory themes emerged: rules covering accounting and Nippon Individual Savings Account (NISA). When firms use derivatives to hedge, the difference in accounting treatment between derivatives and cash markets can impact the economics of the position. Respondents cited instances where they want to use derivatives to hedge a cash instrument. While the economics of the hedge may work, the accounting treatment results in a less economically viable trade. This issue is present in multiple jurisdictions, and is an important consideration for Japanese firms.

There are restrictions on derivatives in NISAs which, by design and definition, limit certain funds from the market. Regulators, of course, need to ensure these vehicles are safe for investors, but restrictions reduce the number of market participants.

Local knowledge of nuances: The level of derivatives expertise across legal, operations, risk, and other key stakeholders in Japan has been somewhat limited due to lower usage. Derivatives are unique, and the entire life cycle—from negotiating legal agreements to settling a trade—has complexities. A lack of in-depth knowledge of the post-trade process can make derivatives trading more costly and risky. Negotiating legal agreements that govern derivatives trading is a specialized field, and the lack of legal knowledge at some firms in Japan slows the process down.

Future-proofing derivatives to enhance asset management

According to our interviews, building a more vibrant derivatives ecosystem is important to the Japanese asset management industry. There are a multitude of benefits that accompany an enhanced derivatives market.

Portfolio management: Respondents use derivatives for several reasons, but the most cited is hedging and risk management, which are necessary to effectively manage a portfolio. Improved portfolio management makes a firm more competitive globally and helps attract more assets to invest.

According to our research, the top concern of Japanese IRD traders in 2024 was inflation. Further, respondents think that Japan will shift from deflation to inflation; and as inflation and interest rates change, there is a risk to portfolios that could lead to a greater need for derivatives (e.g., inflation swaps). As one foreign asset manager based in Japan stated, “OTC derivatives play an important role in controlling the overall yield curve risk.”

Product development: Different investors need different products. Some want stable returns with little to no risk. Others want enhanced yields and return. To become more competitive globally, the Japanese asset management industry could expand the types of investment products they offer. And as the complexity of the strategy increases, the need to incorporate derivatives may increase as well.

Respondents understand that diversification of investment products keeps them relevant as conditions change. A flourishing derivatives market will help with new product development, whether a strategy that combines interest yield with derivatives, or absolute return funds.

Asset managers in Japan recognize the value derivatives provide and state that they cannot only help achieve investment objectives but also take it further: “There are funds where it is difficult to achieve the objectives without actively using derivatives.”

Conclusion

Our research confirms the importance of derivatives to the Japanese asset management industry, with respondents recognizing their value in helping achieve investment objectives. A more vibrant derivatives ecosystem is, in fact, essential for Japanese asset management. Therefore, there are several ways the market can be improved to support the growing demand for derivatives, including increased capacity and knowledge across the entire workflow, and continued progress in clearing. Attracting more participants should help with liquidity, which is currently an issue in some instrument types.

A more developed derivatives market in Japan will provide numerous benefits, including improved portfolio management, innovative new product development and better risk management. By addressing the existing challenges and impediments, Japan can enhance its asset management industry and help achieve its long-term ambitions.

Stephen Bruel is a Senior Analyst on the Market Structure & Technology team.

1OTC derivatives statistics publication table: BIS,DER_D7,1.0

2Triennial Survey publication table: BIS,DER_D12_2,1.0

3Interest Rate Swap | Japan Securities Clearing Corporation

4https://www.cftc.gov/node/256711

MethodologyCrisil Coalition Greenwich, in partnership with ISDA, conducted an in-depth study with 20 senior derivatives market participants based in Japan between June and August 2025. The research includes findings from global asset managers with offices in Japan, domestic Japanese asset managers and Japanese asset owners. The interviews sought to uncover trends in OTC derivatives usage among asset managers in Japan, assess the alignment with their investment strategies, and explore both opportunities and structural impediments to deeper market engagement. Assets under management (AUM) at respondents’ firms ranged from ¥100 billion to over ¥70 trillion, with half managing more than ¥40 trillion in assets. This report intends to inform future dialogue on market development, policy support and infrastructure enhancements consistent with Japan’s long-term financial ambitions.