Digital asset market structure to date has been built primarily with retail, high-net-worth, venture capital, family office, and crypto-native investors in mind, as they have been the most ready to adopt digital assets. The market has also been built around direct ownership of assets. Platforms liked Binance, Coinbase and Gemini were initially developed to support these types of investors who wanted simple means for buying and holding Bitcoin and other digital assets directly.

However, as traditional institutional investors, fund companies, custodians, and banks make moves, and we shift from physical ownership (e.g., holding actual Bitcoin) to both physical and financial instrument ownership (e.g., trading Bitcoin futures and/or holding Bitcoin ETFs), crypto market structure will increasingly be influenced by the demands of institutional investors and traders.

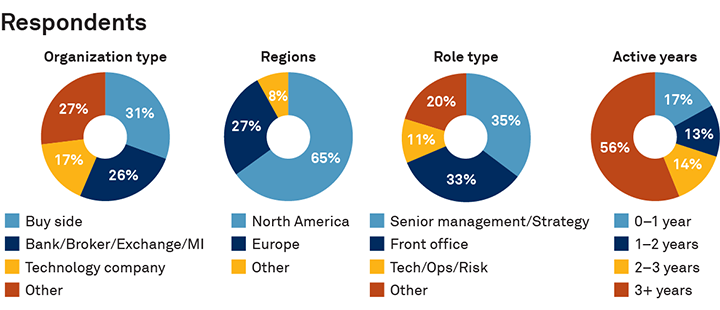

MethodologyIn July of 2021, we interviewed 108 executives at financial institutions and technology firms around the world to better understand use cases, deployments, preferences, benefits, disadvantages, and the overall appeal of digital assets. Respondents comprised asset managers, banks, brokers, exchanges, market infrastructures, technology companies, and other market participants.

We spoke with professionals in various roles across the front office, technology/operations/risk, senior management, and strategy teams. Over half of the respondents have been active in digital assets or blockchain technology for three years or more.