Crypto is dead, long live crypto.

Recent Coalition Greenwich research shows the U.S. and U.K./European crypto markets to be highly resilient and advancing despite heavy scrutiny and uncertainty in the U.S. market. Asset managers and hedge funds are positive and upbeat about the growth opportunity of the asset class as well as the commercial opportunity to offer a range of investment funds, exchange-traded funds (ETFs) and even new digital asset securities.

While some asset managers are more enthusiastic with traditional use cases in the asset class (investing, trading, products), others continue to be attracted to the potential of decentralized finance (DeFi). In a surprising twist, these same managers are optimistic about the U.S. market over the next five years and its ability to offer frameworks as well as prudent regulation to support the development of the market.

The crypto markets always seem to advance even in difficult troughs. And while Dubai, Singapore and Switzerland can also support crypto hubs in a positive fashion, the U.S. and U.K./European opportunity is also strong. In the meantime, banks and other intermediaries see an opportunity to support tokenization of assets (both financial and real-world assets (RWA) and DeFi), with proofs of concept (PoCs) and pilots across the globe.

Infrastructure, including well-regulated custody, is critical to the development of the ecosystem. However, the next arms race is going to be centered on data, analytics and tools to support front-office professionals (PMs, analysts and traders) in their never-ending request for higher returns and the ever-elusive alpha.

Spending on crypto market data, on-chain data, as well as portfolio and risks systems are very much on the radar for the next 6 to 12 months, suggesting firms will be on firmer ground when the clouds clear and sunny skies appear next.

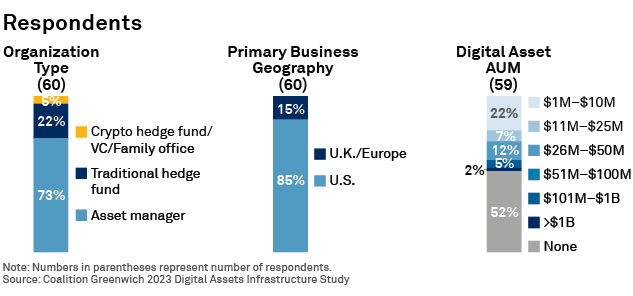

MethodologyBetween May and June 2023, Coalition Greenwich conducted research, in partnership with Amberdata, to better understand how institutions are implementing digital assets, including investment strategies, products, data, and technologies to support the asset class. We conducted online interviews with 60 buy-side professionals from asset managers, hedge funds and other investors in the United States and the United Kingdom/European Union. Their roles include portfolio managers, traders, analysts, researchers, and managing directors.

Almost half (48%) of these buy-side respondents have digital assets under management (AUM), reflecting a mix of active investors and those with some curiosity. In addition, we conducted extensive qualitative interviews with several sell-side institutions and infrastructure players active in the market, to round out the findings on use cases, pilots and infrastructure used to support digital asset trading and investing.