Until recently, the role of the market structure analyst has been straightforward: determining the rate at which the capital markets were going electronic. First in equities, then in FX, and finally in credit and rates, the advance of electronic platforms against open-outcry markets or the use of the telephone has been the central narrative. Structural analysis during this phase focused on the advances in technology that made it possible, as well as regulations which encouraged or slowed its growth. As e-trading has advanced through a more or less unbroken string of triumphs, this story is no longer front and center. The second-order effects of electronification are now the focus. Trying to determine just what the shift to electronic means is much less straightforward.

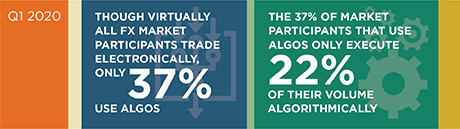

Electronification has created opportunities that were not possible when data ingestion was limited by the refresh rate of the human eyeball and order entry by the pace of conversation. Perhaps the most interesting and most analyzed second-order effect is the spread of algorithmic trading. Originally, market makers were interested in automated trading. The ability to use technology as a substitute, or multiplier, for capital was essential to the advance of electronification. This is often not well understood by the public nor, in some cases, by those merely a step removed from the trading strategies made possible by high-speed communications and increased computing power. Today, liquidity providers use auto-quoting technology across all asset classes.

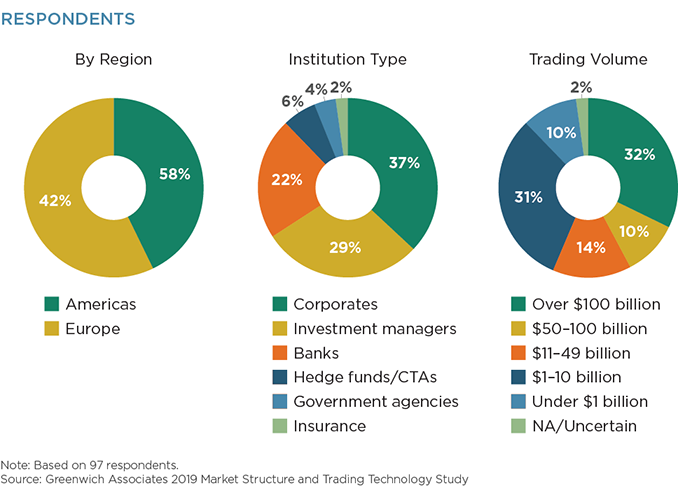

MethodologyThroughout June and July 2019, Greenwich Associates interviewed 97 FX investors as a part of our annual Market Structure and Trading Technology Study. Respondents were asked how they select an FX trading platform, how they determine quality execution, as well as the influences of selecting an FX algo.