Emerging-market economies—those that are newly industrialized but have not yet fully developed—have proven themselves attractive to global fixed-income investors over the past decade. The perpetual search for yield has driven investment dollars from low-interest-rate developed markets into more risky emerging markets in hopes of improved returns.

While the search for yield is nothing new, accessing emerging-market fixed income has been a non-trivial pursuit for foreign investors. Global investment banks provided institutional investors access, but at a high cost. Banks local to those markets could help, but often stayed focused on local customers. And even if market access had deep, accurate and trusted pricing, data was often elusive.

But as electronic trading has increased access to both data and markets in the developed world, the same is happening in emerging markets. Technology is increasing the flow of information, removing the language hurdle and connecting disparate brokers and investors from all over the world, allowing trades to consummate that only a few years ago would have been too expensive if not impossible to get done.

Nevertheless, e-trading in emerging-market fixed income is, well, emerging. To understand where we are now and where we are likely headed, it is critical to fully grasp the diversity that is emerging-market fixed income. These markets are as diverse as the cultures of the countries and corporations that issue the debt, and electronic platform providers and their users need to recognize those nuances to ensure that progress continues.

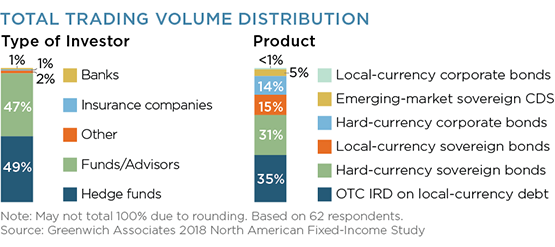

MethodologyBetween February and April 2018, Greenwich Associates interviewed 62 U.S.-based emerging-market fixed-income investors, primarily from hedge funds and investment managers. Interview topics included trade and research activities, product and dealer use, as well as electronic trading behavior.