The financial services industry is in the midst of a massive leap forward, with the next generation taking on more leadership roles and technology changing the nature of the business. Financial advisors are seeing their fair share of this disruption. The expected $30 trillion intergenerational wealth transfer, margin pressures due to investments shifting from actively managed to index-tracking funds, and technology innovations such as robo advisory are all reshaping investor and advisor perceptions of what makes a good advisor today and in the coming years.

To better understand these changes and their impact on financial advisors, we partnered with Bloomberg Media Group’s Data Science and Insights team, led by Michelle Lynn, in the development and analysis of online interviews that Greenwich Associates conducted with over 10,000 financial advisors between 2017 and 2019. The resulting data has allowed us to segment these advisors beyond the usual cuts of assets under management and client focus, generating insights that will allow marketers and others trying to reach this community to do so more effectively. And while the number of financial advisors is expected to further decline in the next three to five years, those remaining will continue to have an outsized influence on investor behavior, product selection and the shape of the industry going forward.

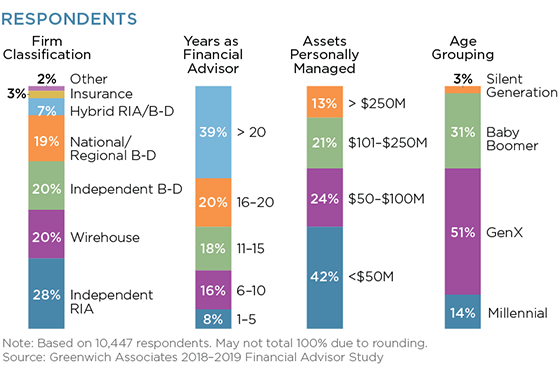

MethodologyBetween July of 2017 and May of 2019, Greenwich Associates conducted 10,447 online interviews with financial advisors located within the United States. Study participants were active financial advisors currently managing primary client relationships. Questions explored the current state of the financial advisory business, the changing nature of client interactions, the impact of technology on the business and media consumption habits.